Last Updated on December 17, 2025

You are about to get a clear, data-driven view of the vertical SaaS landscape and where the fastest market momentum lives today.

Enterprise software grew 11.1% in 2023 and the sector projects steady gains. Specialized solutions now show faster growth—forecasts put sector expansion between 12.3% and 15.2% through 2034. That shift matters for your roadmap and fundraising pitch.

Cloud leaders like AWS, Azure, GCP, Salesforce, ServiceNow, Snowflake, and Workday are doubling down on industry plays. AI and embedded fintech are compounding forces, driving revenue and retention lifts of 2–5x for some companies.

Expect better unit economics from focused vendors: lower S&M-to-revenue ratios (about 17% vs. 34% for broad competitors) and higher retention. This section gives you practical insights to align product, GTM, and growth plans for 2025–2026.

Key Takeaways

- You’ll get a clear map of the market so you can spot high-momentum niches.

- Specialized software often outperforms horizontal peers on churn and efficiency.

- AI and embedded fintech are accelerating product value and monetization.

- Major cloud and public companies now prioritize industry solutions.

- Data shows better unit economics for focused players—use this in your GTM and pitch.

- Preview sectors primed to break out in 2026 to guide your roadmap.

Why the vertical SaaS landscape is outpacing horizontal software right now

Specialized cloud products are accelerating faster than general-purpose software, and the numbers explain why. Forecasts put vertical saas growth between 12.3% and 15.2% through 2034, while enterprise software projects roughly 9.6% CAGR through 2032.

Market growth divergence and efficiency metrics you can bank on

Targeted vendors run lower sales-and-marketing ratios — about 17% vs. 34% for broad platforms — which translates to faster payback and higher returns. You can use that math in your pitch and planning.

SMBs juggle ~16 apps on average, creating a real toggle tax. Consolidating tools into purpose-built solutions reduces friction and improves operations and ROI quickly.

From “poor cousin” to category leader: what changed in a decade

Buyers now demand preconfigured integrations and role-specific workflows. Major cloud vendors and enterprise platforms push industry plays, accelerating adoption and proving scale.

“AI and embedded fintech shorten time-to-value and make niche solutions easier to justify.”

- You get better retention and lower churn with tailored solutions.

- You can leverage AI adoption to deliver measurable wins fast.

- You should sharpen ICP and messaging around efficiency and growth.

Defining vertical SaaS versus horizontal SaaS for today’s market

Industry-specific software embeds the language, checks, and steps teams use every day, so adoption is faster and less disruptive.

Industry-specific workflows, compliance, and integrations explained

Products built for a single sector ship with preconfigured workflows, terminology, and compliance rules. That means faster deployment and lower change management for your teams.

By contrast, general-purpose software spans many industries and often needs heavy customization. You trade breadth for built-in features when you choose specialist solutions.

- Aligned to needs: You’ll see industry requirements and processes reflected in the UI and data model.

- Faster time-to-value: Prebuilt integrations and domain expertise reduce rollout time.

- Tradeoffs to plan for: Expect integration work to connect these products to your broader stack and management tools.

- Vendor evaluation: Treat these suppliers like core systems; check viability, security, and compliance.

Mixing specialized and general-purpose apps is often the best approach. Pair industry-grade capabilities with broader platforms to cover gaps and keep users productive from day one.

The market forces reshaping software in 2025-2026

Fragmented tool stacks are the silent productivity tax dragging most teams behind. SMBs now juggle about 16 SaaS tools, creating constant context switching and wasted hours.

Rising customer expectations mean you must deliver cohesive workflows and clear ROI. With 91% of businesses running digital initiatives and 87% of leaders prioritizing digitization, adoption favors products that shorten time-to-value.

Trading market size for market share

Focused vendors often target smaller TAMs but capture bigger slices of their industry. Examples: Shopify powers ~29% of ecommerce sites and Mindbody owns ~61.5% in its niche.

Embedded fintech and AI as compounding levers

Embedding payments and AI can boost revenue and retention by 2–5x. You gain measurable lifts when finance flows and intelligent workflows become core to everyday operations.

- Eliminate the toggle tax: fewer tools, tighter workflows, better customer experience.

- Leverage transformation tailwinds: digitization expands your reachable market.

- Focus R&D & GTM: a narrow ICP improves efficiency versus broad platforms.

AI’s platform shift: from systems of record to systems of intelligence

Large language models rewired expectations: AI now moves platforms from passive record-keeping into active decision systems.

You can use proprietary, contextualized data to train models that really understand your domain. ChatGPT hit 100M MAU in two months and OpenAI is pacing for a billion-dollar run rate, proving scale matters for model utility.

Leveraging proprietary data to power machine learning

Your product’s contextual data fuels machine learning that predicts and prescribes. This turns stored records into actionable insights.

Predictive analytics, NLP, and intelligent workflow automation

- Domain-aware models: Use industry data to improve forecasts for demand, risk, or throughput.

- Automated decisioning: Upgrade your platform to surface next-best actions and reduce manual steps.

- Industry NLP: Deploy natural language models tuned to jargon so assistants and search actually work.

- Compound capabilities: More use equals more data, better models, and smarter solutions over time.

Prioritize explainability and safety. Ground your AI roadmap in transparent outputs so stakeholders adopt faster and margins improve without large headcount increases.

Proven growth playbook for vertical SaaS platforms

Begin with a narrow wedge: a sector where legacy tools create repeated operational failures and measurable dollar loss. Solve one sharp pain so customers pay and refer.

Find a lagging sector, solve a sharp pain point, then expand

Start where the status quo hurts. Fix a high-impact task, win a beachhead, and use that trust to add adjacent solutions.

Price for value as you become critical to customers’ workflows and capture higher attach rates.

Build multi-product platforms and open fintech revenue streams

Sequence products so each maps to customer management flows. Then add payments, payouts, and lending where money already moves.

- You’ll move from point product to platform by solving connected problems.

- Embedding fintech can multiply revenue and retention by 2–5x.

- Layer AI on your data to turn routine events into proactive solutions.

Focus on cohort NRR, attach rates, and margin discipline. Build deep expertise in one market, then reuse that playbook to unlock new opportunities for businesses and long-term growth.

Case study: Toast and the blueprint for becoming an industry operating system

Toast turned a century-old POS problem into a modern operations engine for restaurants. You can trace the firm’s playbook and apply it to your market.

Targeting legacy-heavy workflows and embedding into daily operations

Toast entered a manual, POS-heavy market and won by owning the checkout and core workflows. Today it serves 113,000+ U.S. restaurants and captures roughly 13% of the market.

How fintech integration shifted revenue mix and lifted retention

By embedding payments and payouts, Toast moved fintech to the center of monetization. Fintech now drives about 82% of revenue while subscription software is 18%.

Net revenue retention hit 121% (2020–2023), showing how platform expansion and payments created durable growth.

AI features that turn data into actionable insights

Toast layered AI—an email assistant, the Sous Chef chat, and data-driven recommendations—to help operators act fast. Fewer than one-third use AI today, but 71.6% plan adoption and ~94% see it as essential.

- Lesson: Own a critical workflow, then add modules that drive stickiness.

- Action: Prioritize integrations that reduce operational friction and show measurable ROI.

Case study: Benchling and the power of SoR-led vertical expansion

Benchling turned a simple lab notebook into a hub that organizes complex research across teams. You see how a frequent, high-value workflow became the entry point for a much larger platform.

By 2021 Benchling served 270,000+ scientists and thousands of organizations. It raised a $100M Series F at a $6B valuation in November 2021 and exceeded an estimated $100M ARR that year with ~100% YoY growth and 169% net retention.

What matters for you: freemium access built a broad base of users and captured rich data. That knowledge pulled the product upmarket into enterprises like Gilead, Sanofi, UCB, and Corteva.

From ELN to life sciences OS: upsell, expansion, and network effects

Benchling expanded beyond the ELN into molecular biology tools, RNA therapeutics, and early development modules. Integrations with frontier tools like AlphaFold kept the product central to cutting-edge R&D.

- Single workflow to platform: ELN usage created habitual adoption that enabled upsell.

- Freemium to enterprise: low-friction entry grew users and created natural revenue motions.

- Domain expertise: prioritize adjacent solutions that match scientists’ daily work to create network effects.

- Data-led growth: captured knowledge shortens development cycles and reduces rework.

“Position the system of record first, then evolve into an operating system with modules that lift growth and retention.”

Use Benchling’s pattern: own a core, high-frequency task, surface clear productivity wins, and then expand into complementary solutions that make teams stickier and more productive. For more on targeted approaches, see vertical SaaS remote work.

Where you’ll see breakout growth in 2026: sectors primed to surge

Expect certain sectors to surge next year as practical automation and data tools finally reach critical mass on the ground. You should watch areas where field teams, legacy operations, and measurable ROI intersect.

Construction: field ops, optimization, and AI progress

Construction firms lag on adoption—about 70% report challenges—but 97% plan bigger digital budgets in three years. You can win by solving jobsite coordination and progress tracking.

Examples: Raken for field ops, Alice for scheduling (17% shorter projects), Doxel for AI progress (11% faster schedules), and Versatile for precision data.

Manufacturing: industrial data and ROI-first deployments

Manufacturing needs software that proves payback on the factory floor. Focus on operations digitization, MLOps, and defect intelligence.

Players: Tulip Interfaces, MakinaRocks, and Instrumental show how industrial data can cut waste and lift throughput.

Healthcare: bottlenecks, virtual care, and decision automation

More than 70% of U.S. adults report unmet needs. Cultural and governance barriers slow adoption, but you can win with automation that maps to real EHR workflows.

Use cases: AI triage and bottleneck prediction from Curai Health and Qventus reduce wait times and improve capacity.

Agriculture: precision workflows and autonomous operations

About 85% of farmers already use at least one precision technique. Tools that blend sensors, autonomy, and crop design deliver clear yield lifts.

Examples: Benson Hill, Verdant Robotics, and Aerobotics show how intelligence and robotics cut inputs and boost output.

Real estate & hospitality: orchestration and consolidation

AI could add $110–180B to real estate; hospitality still lags digitally. Two-thirds of hotels use multiple suppliers, creating room to simplify and optimize.

Solutions: Roofstock, Zillow, Better, Canary Technologies, and SiteMinder help consolidate stacks and raise occupancy while cutting costs.

- You’ll prioritize sectors with clear operations pain and measurable ROI.

- Focus your roadmap on deployable features and data that prove outcomes fast.

- Choose markets with moderate adoption to maximize runway and near-term value.

“Pick markets where one improvement changes daily operations—those wins drive rapid adoption and expansion.”

For plays that pair product and go-to-market around real workflows, see vertical SaaS remote work.

Go-to-market and monetization moves that win in vertical SaaS

Winning go-to-market moves focus on one clear buyer and measure what operators actually value.

Design your GTM around a narrow ICP to shorten sales cycles and raise win rates. Focused sales teams and tailored messaging are cheaper to run; vertical vendors report ~17% S&M-to-revenue vs 34% for horizontal peers.

Specialized sales efficiency and targeted R&D

Align R&D to the highest-impact use cases. Ship small features that directly improve throughput, error rates, or cash flow.

Ship what customers use. That lowers churn and turns product usage into expansion signals.

Land, expand, and embed payments to scale revenue

Start with a single, repeatable win and expand outward. Use product-led growth so usage surfaces upsell paths and makes account management easier.

Embed payments and financial services where transactions happen. Leaders like Toast show how fintech can become the primary revenue engine and lift retention 2–5x.

- Design GTM for a tight ICP so every sales dollar works harder.

- Target R&D to ship features that prove ROI fast.

- Execute land-and-expand with product usage as the signal for expansion.

- Embed payments to unlock higher ARPU and better unit economics.

“Make the product indispensable by solving core workflows, then add services and modules that keep customers inside your platform.”

Capital markets reality check: valuations, M&A, and what it means for you

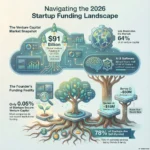

A higher cost of capital changed the playbook: efficient growth now beats rapid burn. The Fed’s shift away from ZIRP added more than five percentage points of hikes, and valuations have normalized to 2014–2018 ranges.

This matters because fundraising now rewards operational discipline. Private vertical saas markets show slower M&A activity and steadier price tags. The unicorn median sits near $1.7B while outliers like ServiceTitan trade near $9.5B.

From ZIRP to sustainability: the return to fundamentals

You’ll operate in a market that prizes profitable growth, not blitzscaling. Emphasize efficient sales engines, rising NRR, and capital discipline over vanity metrics.

Product tuck-ins and consolidation signal the next phase

Expect more tuck-ins as companies shore up capabilities fast. Recent deals—Clariti buying Camino, Zendesk acquiring Tymeshift, and Procore buying Unearth—show how acquirers fill gaps with targeted purchases.

- Plan: align valuation narratives with unit economics and defensible moats.

- Use M&A: to add technology or enter adjacencies faster than building.

- Win mindshare: show pragmatic machine learning and data-led solutions that improve outcomes in your space.

“A steadier cost of capital enforces discipline and produces healthier businesses.”

Risks, constraints, and how to de-risk your vertical SaaS bet

Before you sign an agreement, map how a niche solution will touch your existing systems and teams. That short exercise reveals hidden dependencies, migration steps, and key stakeholders.

Integration complexity, vendor viability, and premium pricing

Integration complexity can create silos if you bolt new software onto legacy processes without a clear data flow. Plan integrations early to avoid brittle processes and make sure workflows move across systems without duplicated effort.

Vendor viability is a real concern. New providers often deliver deep domain value but carry higher switching costs. Assess vendors with financial checks, security audits, and roadmap diligence that match how mission-critical the product is.

Premium pricing reflects industry expertise and compliance work. You’ll justify higher fees by tying outcomes to measurable efficiency gains and reduced operational risk that matter to operators and executives.

- Design contracts with uptime, data portability, and clear exit paths to limit long-term exposure.

- Align solutions to actual business needs, not feature lists, to secure adoption and value realization.

- Mix a vertical core with proven horizontal components where it improves reliability, cost, or speed.

- Monitor operations metrics after launch to validate results and guide continuous improvement.

“Mitigate integration and supplier risk by treating vendor selection like infrastructure — not just a feature buy.”

Conclusion

Winning in niche markets now means turning deep domain knowledge into repeatable software moves. Focus your approach on a single high-impact pain, prove value fast, and let that trust fund expansion into adjacent features and platforms.

You can turn your system of record into a system of intelligence by using data and industry knowledge to surface actionable insights. Embed fintech and AI where money and decisions flow to lift adoption and efficiency.

Plan with clear requirements, clean integrations, and user-centered design so users see ROI in a short time. Apply lessons from Toast and Benchling: start with a wedge, expand into workflows, and build a durable platform that makes your product indispensable.