Last Updated on January 22, 2026

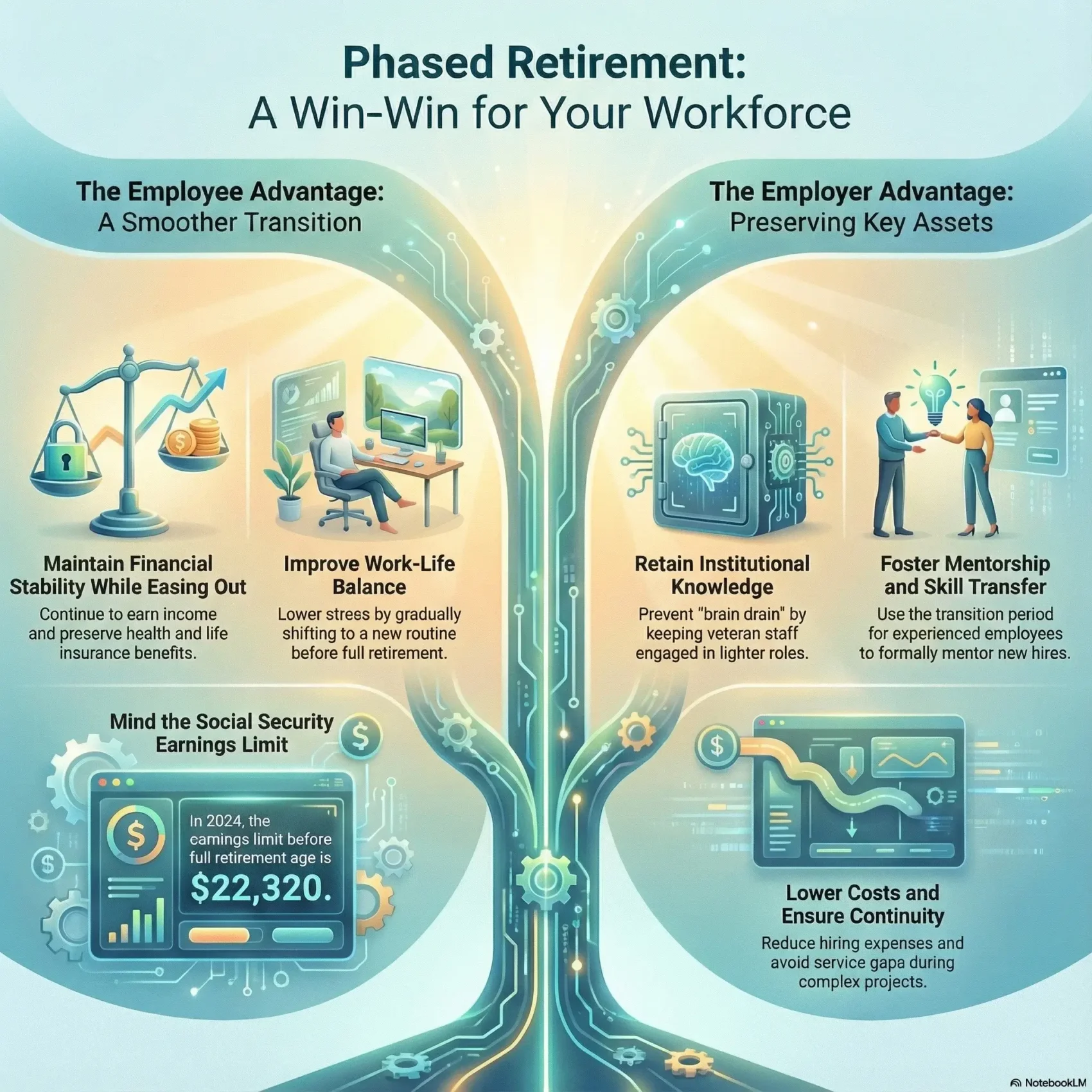

You’re learning how a gradual workforce transition works—a program that helps full-time staff shift to part-time schedules while they begin drawing benefits. This approach aims to keep income flowing and preserve your institutional knowledge as you change your work rhythm.

Federal rules changed in 2014, allowing agencies to implement formal elections and use forms like SF 3116 to document status. Agencies followed OPM guidance so managers and HR could support employees and protect health coverage and service records.

This model helps managers pair mentoring with continuity of service. It gives you time to plan, pick the right elections, and complete paperwork without abrupt change.

Key Takeaways

- You’ll get a clear view of how gradual transition programs preserve income and knowledge.

- Federal guidance and forms guide eligibility, timelines, and health coverage choices.

- Managers can use the program to mentor and reduce disruption to teams.

- Planning your age, years of service, and elections protects long-term benefits.

- Start conversations early and use resources like work-life balance guidance to plan time and goals.

What phased retirement means and why it matters to you

Cutting back your schedule over months or years lets you test a new routine without losing income right away. In plain terms, phased retirement is a plan that reduces hours or days so you keep working while freeing time for life outside the office.

Common models include part-time roles, seasonal work, temporary assignments, and job-sharing. These options help you preserve benefits and stay engaged while you decide whether to move to full retirement.

You should weigh your age and timing carefully. Claiming Social Security before full retirement age can trigger earnings limits. Waiting keeps benefits intact and avoids reductions.

- Keep income while you test-drive the next life phase.

- Match workload and schedule to family and financial plans.

- Talk with HR and your manager early so the plan fits operations.

For help mapping flexible options and schedules, see flexible work schedules. This step lets you reduce risk and adjust pace as your goals change.

The business case and employee benefits of phased retirement

Keeping veteran staff on reduced schedules can deliver clear financial and operational wins for both you and your employer. This approach preserves steady pay while easing the strain of full-time work. It also protects well-being in a pivotal year as you balance age, goals, and hours.

How a reduced workload preserves income and well-being for employees

Cutting hours, not ties, lets you keep a reliable income stream and maintain benefits while lowering stress. A smaller workload gives you time for health, family, and planning without a sudden drop in pay.

Retaining institutional knowledge and lowering replacement costs for employers

Employers keep critical service knowledge when long-tenured staff stay on in lighter roles. That overlap lowers hiring costs and avoids gaps during busy seasons or complex projects.

Mentoring pathways that strengthen service continuity and skills transfer

Designing mentoring into the plan turns retirees into active guides. They document processes, update playbooks, and coach new hires so teams stay productive as experience transfers.

- Overlapping tenures keep performance steady.

- Pay and incentives can reward outcomes, not just hours.

- Leaders can track ROI via reduced hiring and faster onboarding.

Eligibility criteria and program models you can adapt

Knowing who qualifies and which models exist helps you pick the right path for a gradual transition. Start by checking age and years of pensionable service rules for your system. Federal guidance allows full-time staff to move to part-time schedules while drawing benefits, using SF 3116 and BALs (for example, BAL 14-112) to document elections.

Federal approach: part-time schedules while drawing benefits

Federal plans let you keep benefit accruals and health coverage while reducing work hours. Elections are formalized with agency forms so payroll and HR apply pro-rata salary, leave, and contributions.

CUNY example: flexible workload and pay options

At CUNY, eligible faculty and staff 65+ with 15 years in TIAA may phase up to three years. Tenured faculty often work 50% for 50% salary. HEO/CLT roles may get 80% salary for a 20% workload cut, typically four days per week.

Participants keep full health benefits, with contributions and leave calculated pro-rata. TRS members usually cannot join due to final-salary benefit rules.

Private-sector variations you can adapt

- Part-time or reduced days across the week

- Seasonal or temporary roles tied to peak periods

- Job-sharing to split workload and preserve salary budgets

How to design and roll out a phased retirement program

Define program outcomes first so every stakeholder knows what success looks like. Start with goals like knowledge transfer, coverage stability, and measurable service outcomes.

Define objectives, roles, and timelines for a multi-year transition

Set clear objectives and assign roles for managers, HR, payroll, and the employee. Map multi-year timelines that match budgeting cycles and staffing needs.

Set workload, schedule, and pay parameters tied to years of service

Calibrate workload and pay to an employee’s years of service so the plan is fair and predictable. Decide on week-based or semester-based schedules and how coverage will work during peak time.

Use standard forms and clear elections to formalize participation

Operationalize participation with the correct form and instructions. Agencies use SF 3116 and OPM BAL guidance (for example 14-109 and 14-307) plus SF pamphlets for FERS and CSRS transitions.

Align HR, payroll, and managers on approvals and processing

Create a simple intake, approval, and runbook so HR, payroll, and managers process elections consistently. Embed mentoring deliverables and documentation into workload to capture institutional knowledge.

- Design a review cycle to track outcomes and budget adherence.

- Communicate timelines and approvals early to reduce delays.

- Use a single form-based workflow to document every agreement.

Phased retirement compliance, pay, and benefits

Compliance and pay rules shape how you keep benefits and earnings while you shift to a lighter work schedule.

Health and life insurance under FEHB and FEGLI

FEHB and FEGLI have clear guidance for phased status. OPM BAL 14-209 and 14-208 confirm continued health and life insurance coverage when you move to part-time work.

Premiums and eligibility usually continue, but you must document status with the correct form so payroll keeps deductions accurate.

Pension contributions and service credit rules

Your retirement system continues contributions while you work part-time. Pro-rata service credit applies for the period you reduce hours.

That means your service totals and future annuity calculations reflect time on payroll during the reduced schedule.

Social Security earnings limits and tax basics

For 2024, the earnings limit before full retirement age is $22,320; in the year you reach full retirement age it rises to $59,520. Excess earnings trigger benefit reductions per OPM guidance.

Each monthly annuity is split into taxable and tax-free portion amounts using CSRS or FERS present value factors. The composite annuity and remaining tax-free basis are set at final retirement (see IRS Publication 721 and Notice 2016-39).

- Confirm SF 3116 elections per OPM BAL 14-112.

- Check contributions, coverage, and withholding with HR and payroll.

- Keep a simple checklist of forms, service records, and official numbers for the period.

Phased retirement scheduling, knowledge transfer, and measurement

A clear daily rhythm makes it easier for employees to reduce hours without losing impact. Structure your plan around simple blocks: full days, split days, or semester loads. That helps you keep service consistent while shrinking a person’s workload.

Structuring days, hours, and semesters for reduced workload

Use flexible options that match your operations. Faculty can take a 50% workload in one semester or spread it across two. Staff often move to a four-days-per-week schedule to keep coverage steady.

Tip: Set firm hours for student or client contact and reserve one day for documentation and handoffs.

Building formal mentoring into your plan to capture institutional knowledge

Make mentoring a deliverable in each reduced schedule. Add shadowing sessions, documentation sprints, and training checklists to the weekly time allocation.

- Define success metrics like turnaround, onboarding speed, and error rates.

- Schedule regular check-ins and short retrospectives to refine the work plan.

- Use simple tracking tools so managers can validate outcomes and escalate issues early.

Outcome: You keep vital knowledge in the team, protect service levels, and show measurable gains during phased retirement.

Phased retirement

Start your application timeline early so approvals, signatures, and final dates align with campus cycles. Timely planning reduces stress and keeps benefits on track.

Planning your application period, approvals, and end-of-phase

Key dates matter. CUNY applicants must apply by November 15 each year and must irrevocably commit to retire at the end of the phasing period. Participation can last up to three years.

- Meet your chair/supervisor early and collect signatures from you and your manager.

- Submit the proper form, note your application number, and confirm receipt with HR.

- Align choices with your retirement system and years of service to meet eligibility rules.

- If a proposed 50% schedule is denied one year, the unchanged plan must be accepted the following year.

- Map the participation period across semesters or weeks and document mentoring and service deliverables.

At the end, lock your final date, confirm president-level approval, and use a short checklist for handoffs, access changes, and benefits transitions so the retirement program closes cleanly.

Conclusion

Finish by checking the numbers, and confirm the amounts that shape your final annuity and tax-free portion under CSRS/FERS present value rules.

Make a short checklist: SF 3116 and related BAL references, payroll entries for salary and pay adjustments, contributions, and documentation of pro-rata service and health coverage.

Lock your schedule and end date so managers can plan workload, days, and mentoring handoffs. Explain the program value in terms of steady work and knowledge transfer.

When questions arise, escalate early so withholding, benefits, and the composite annuity amount are correct before you move to full retirement.