Last Updated on December 1, 2025

You’re entering a new work era where holding more than one role is common and practical. The concept grew from earlier ideas like portfolio careers and “slashers,” and it now shapes how many professionals design their days.

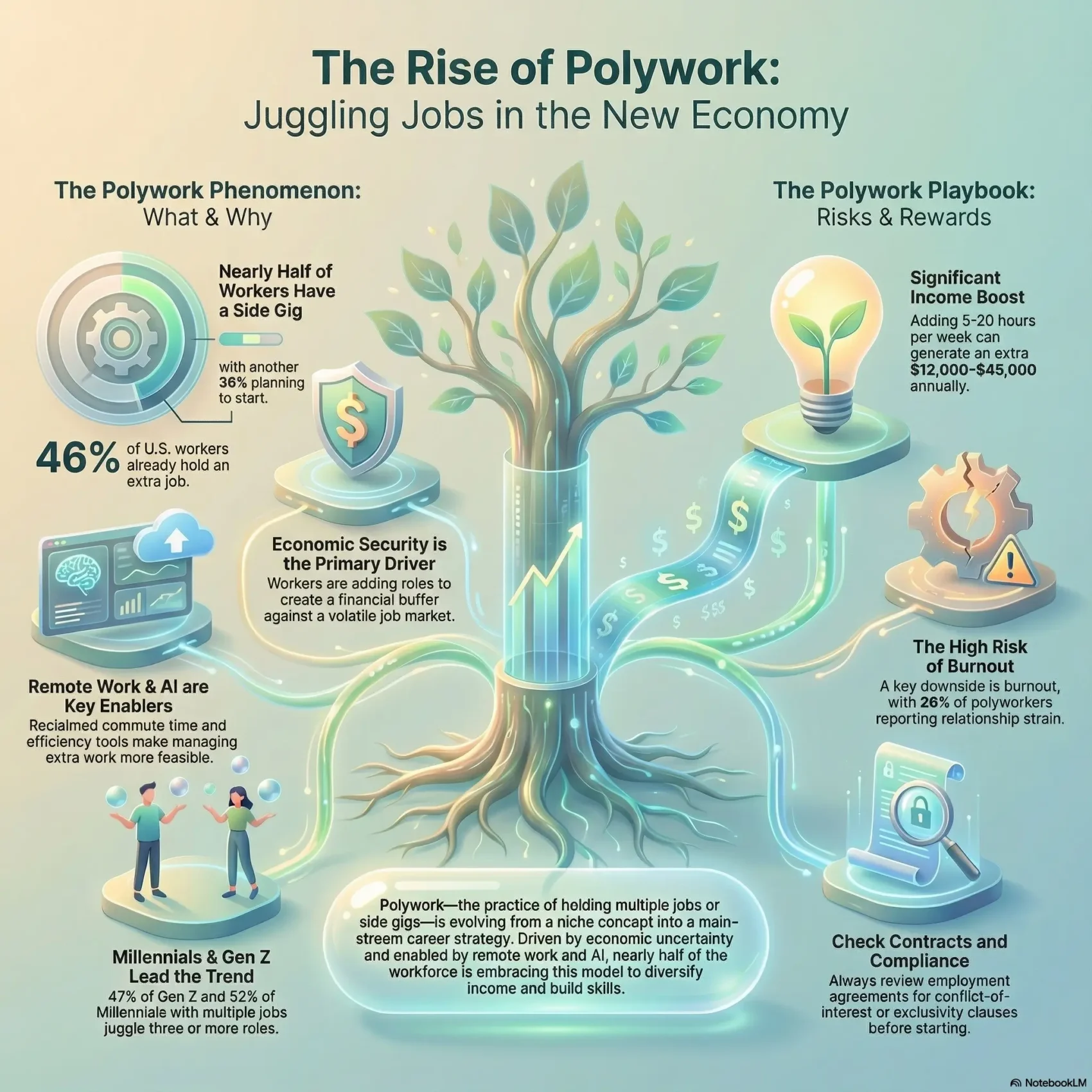

Nearly half of workers already juggle a side gig or extra job, and many more plan to start. Post‑pandemic shifts, reclaimed commute time, and AI tools have sped the rise of managing multiple jobs alongside a main role.

This short guide helps you see the big picture. You’ll learn what polywork looks like in practice, who is doing it across the United States, and why employers and workers both gain from broader skills and fresh ideas.

Key Takeaways

- Polywork grew from portfolio careers into a mainstream culture of multiple jobs.

- Pandemic changes and tech efficiency make holding extra roles easier now.

- Workers across industries, not just creators, are embracing this shift.

- Employers gain adaptability, diverse skills, and better retention.

- This series will show how to position your work for long‑term career value.

What the polywork trend looks like right now in the United States

Today, holding more than one role is part of many Americans’ normal workday. The idea grew from older concepts like portfolio careers and the so‑called “slashers,” and it now reads as a culture where multiple roles are accepted and discussed openly.

From portfolio roots to a new culture

The lineage matters: what began as niche freelancing evolved into people openly stacking jobs. Millennials and Gen Z helped normalize this as a valid way to build skills and income.

How common is it?

Numbers show scale: Owl Labs found 46% of workers already have a side hustle or extra job, and 36% plan to start. Academized reports 52% of millennials hold more than one job; many juggle three or more roles. A 2023 Paychex poll found almost half of Gen Z manage multiple jobs, with 47% handling three-plus gigs.

Why the timing matters

Remote norms, reclaimed commute time, and volatile markets made adding another job easier. For many, the shift began during the pandemic and followed as a practical route to better financial security.

- Origins: portfolio careers → slashers → today’s setup.

- Scale: nearly half of U.S. workers now balance extra jobs.

- Durability: structural work changes suggest this is likely long‑lasting.

Explore how this compares to your field and consider practical steps in the evolving gig economy 2.0.

Why you’re seeing more people take on multiple jobs and side gigs

More people are adding extra roles to their weeks as a direct response to economic uncertainty. You’re likely noticing a steady rise because workers want extra income and a buffer for their household financial security.

Economic reality: Financial security in a volatile job market

You may take a second role to protect your household. Career coach Lynn Berger points to both financial security and creative fulfillment as key drivers.

“Many choose a side role to build security and test new skills,”

Remote work, AI, and reclaimed commute time as enablers

Remote setups and shorter commutes free up time, and AI tools boost output. Together, these make polyworking easier to start and keep discreet.

Generational momentum and realistic income expectations

Millennials and Gen Z normalize holding multiple roles: Academized finds many millennials have three or more jobs, and a 2023 Paychex poll shows 47% of Gen Z juggle three-plus roles.

Adding 5–20 hours a week can produce roughly $12,000–$45,000 extra income, a practical band for many people weighing a side job.

- Protect income: a second role can strengthen security in uncertain markets.

- Use time wisely: reclaimed hours + AI let you fit a focused side into your week.

- Motives vary: people add work for money, growth, or creative projects—pick a way that fits your strengths.

How polyworking changes your work, life, and employer relationships

When you add a second job, the gains and the risks show up quickly in time, money, and health. You can get extra income and fresh opportunities without quitting your main role.

Upsides for you

Diversified income: multiple jobs reduce financial risk and boost security.

Skills and autonomy: you develop new skills faster and often gain more creative control over your career.

The burnout equation

Burnout rises when schedules collide or recovery disappears. Health and relationships suffer if you stretch time too thin.

Employer perspective

Most companies welcome the fresh ideas and adaptability that employees bring. But missed deadlines or slipping performance lead employers to act fast.

Contracts, compliance, taxes

Review terms closely for exclusivity or conflict-of-interest language before you accept extra work. Avoid double-dipping by separating schedules and documenting hours.

Tax-wise, two jobs can trigger FICA overpayments you reclaim on your return, and combined 401(k) contributions must stay under IRS limits.

- Map upsides: income, skills, opportunities.

- Protect your health: schedule recovery to prevent burnout.

- Check company terms and keep confidentiality airtight.

How to thrive if you choose a polyworking lifestyle

Before you take on extra work, set a simple framework that protects your life and goals. Use small tests and clear rules so new commitments improve your finances and skills without eroding wellbeing.

Decide with intention: a quick checklist

Define your why: name the income, skill, or project goal that justifies extra hours.

Pick the fit: evaluate the job against your energy, schedule, and career goals.

Plan milestones: set 30‑, 90‑, and 180‑day outcomes to measure progress and stop wasted effort.

Protect your time: scheduling, boundaries, and recovery

Map your week with time blocks that match your peak energy. Set firm communication windows and silence alerts outside them.

Bake in recovery: schedule at least one full day off and short nightly rituals so you avoid burnout.

Use tools and templates—AI drafts, checklists, and calendar automations—to cut switching costs and save hours.

Safeguard your career: contracts, confidentiality, and brand

Read contracts for exclusivity, document approvals, and separate accounts and folders to protect confidentiality.

Update your public profiles so people understand your multi‑role value. Align your LinkedIn About and headline to reflect outcomes, not just tasks.

- Pilot one side job first and right‑size your hours.

- Grow a targeted network for complementary opportunities.

- Create an escalation plan that pauses side work if life or primary job needs priority.

For practical steps on balance and boundary setting, see work‑life balance guidance that many professionals rely on.

Conclusion

You face a clear choice: add extra roles for more money and skills, or keep one job and focus your energy. Current data shows 46% already work multiple jobs and 36% plan to in the coming years.

Extra hours often bring $12,000–$45,000 more per year, but 26% report relationship strain and higher burnout risk. Protect your life and day‑to‑day routine by testing one side gig, measuring the number of obligations you can sustain, and setting firm boundaries.

Watch legal and financial guardrails—exclusivity clauses, conflicts, confidentiality, FICA reconciliations, and 401(k) limits—so polyworking stays responsible for you and your employers.

You can make this work for the future: start small, scale only when results and recovery line up, and choose what fits your lifestyle and life goals.