Last Updated on December 23, 2025

Pay for performance adds to base compensation when employees meet clear, measurable goals. It’s common in sales, yet you can adapt it to less-tangible roles by setting specific objectives and metrics.

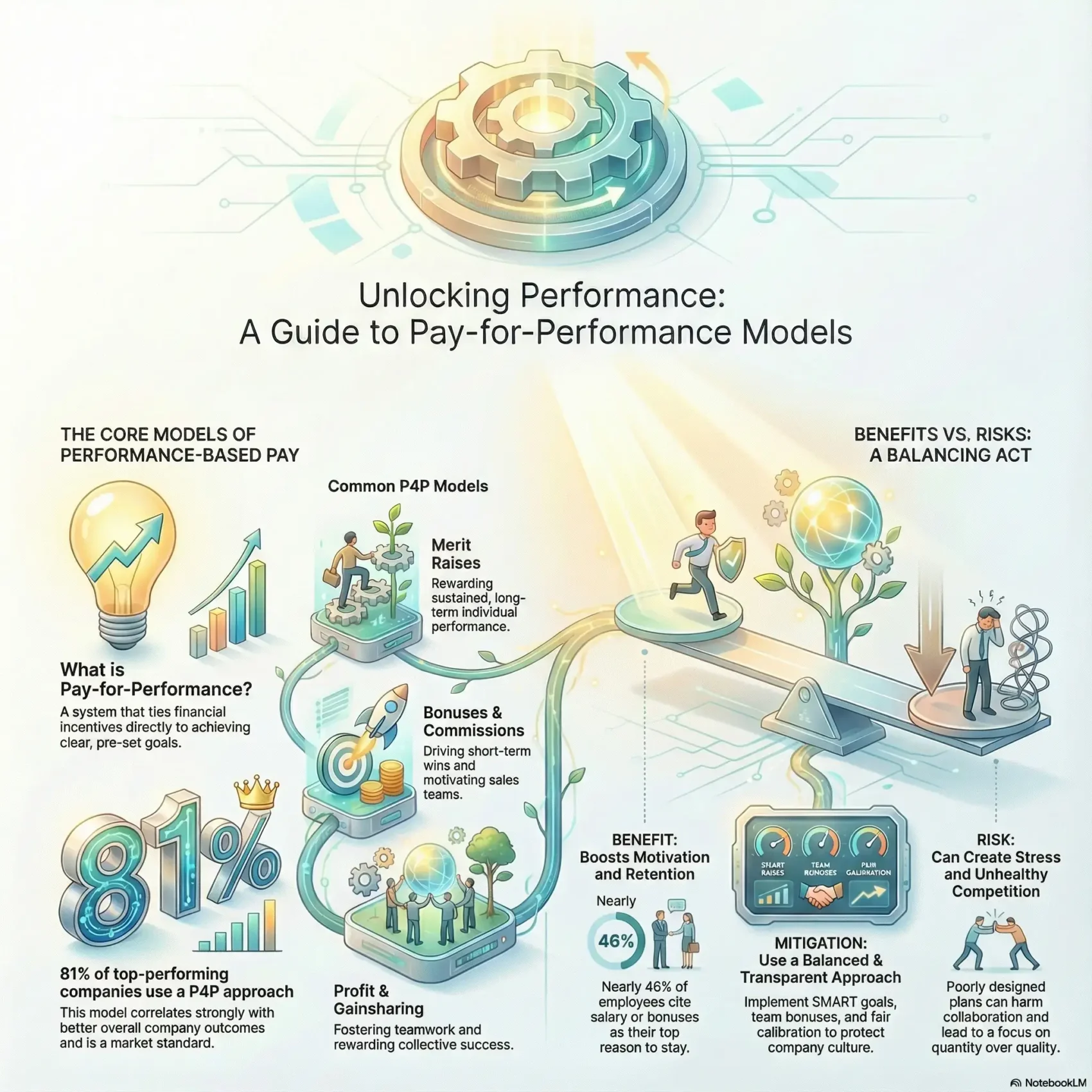

Data matters: 81% of top-performing companies use some P4P approach, and market norms like a 3.5% average merit raise in 2024 shape expectations. Common vehicles include merit increases, bonuses, commissions, profit-sharing, and gainsharing.

There are risks—stress, unhealthy competition, bias, and quantity-over-quality traps. You’ll learn practical mitigations such as SMART goals, transparent criteria, calibration, and tech-enabled tracking to keep the system fair and compliant.

Read on to get a clear, practical model you can test in your business and a set of steps to design scorecards, set targets, and manage payouts so outcomes drive meaningful rewards.

Key Takeaways

- You’ll get a practical guide to align compensation with measurable outcomes.

- Use merit raises, bonuses, commissions, profit-sharing, and gainsharing where they fit best.

- Adopt SMART goals, transparency, and calibration to reduce bias and stress.

- Top performers often use these models—81% adoption among leaders—so outcomes matter.

- Balance cost and culture: track results and protect quality as you reward employees.

What Performance-Based Pay Means Today and Why It Matters

When goals are specific, you can connect outcomes to real rewards. Performance-based pay ties incentives to targets set at the start of a period and tracked with reviews or role-relevant metrics.

How pay-for-performance links rewards to measurable outcomes

Think of the system as a contract: you set clear goals, choose metrics, and agree how employees receive bonuses or other benefits when those targets are met.

Performance-based compensation can boost salary for sustained results or deliver one-time bonuses and commissions for short-term wins. Non-monetary perks — extra PTO or a learning budget — also count as valuable rewards.

Where this approach shines: sales and beyond

It works best where outcomes are obvious, like sales with revenue or units-sold targets. But service, project, and operations roles can use customer satisfaction scores, delivery milestones, or quality KPIs.

- Why it matters: 81% of top companies use these models, which correlates with stronger company outcomes.

- Benefits: Incentives can raise job satisfaction and reduce turnover when goals are realistic and within an employee’s control.

- Practical tip: Balance individual performance measures with company goals so the workforce pulls in the same direction.

For more on aligning tasks and outcomes, see how delegating work can boost productivity via delegating work and boosting productivity.

Performance-based pay: core models, examples, and when to use each

Match your reward system to the clarity of goals and the level of team interdependence. Below are core models you can choose from, with examples and practical guardrails to align incentives with business needs.

Merit raises

Merit-based salary increases permanently raise an employee’s base salary for sustained results. Use merit when individual performance is stable and measurable. Mercer reported a 3.5% average merit increase in 2024, which you can use as a benchmark.

Bonuses and variable pay

Bonuses come in two main forms: discretionary (spot, retention, project) and non-discretionary (tied to pre-set targets).

Discretionary bonuses reward one-off contributions. Non-discretionary bonuses provide predictability and clarity about what employees receive when goals are met.

Commission structures

For sales roles, choose among straight commission, salary-plus-commission, or tiered plans. A common tiered example is 5% up to $50k, 7% to $80k, and 10% above. Align the plan with ramp time and margin sensitivity.

Gainsharing and profit-sharing

Gainsharing splits measurable operational improvements across a team. For example, cutting unit cost from $500 to $285 on 1,500 units can create large distributable gains.

Profit-sharing allocates company profits via cash or retirement plans (DPSP, pro-rata, age-weighted). Use these to reward collective contributions and encourage collaboration.

Non-monetary incentives

Extra PTO, learning stipends, recognition, travel, or equity round out compensation. Many firms blend monetary and non-monetary rewards to keep motivation high without overexposing budget.

- Choose a model based on control over results and clarity of goals.

- Set guardrails — caps, pro-rating, and clawbacks — to protect value creation.

- Mix rewards when you need both individual and team alignment.

Is your organization a fit? Assessing roles, culture, and readiness

Not every role benefits equally from incentive schemes; start by mapping which positions have measurable outputs.

Clear vs. less-tangible performance: mapping roles to metrics

Identify where clear performance exists, such as sales or production. These roles have direct outputs like revenue or units delivered.

For softer work—support, design, or cross-functional project roles—use customer satisfaction, milestone quality, and timeliness as metrics.

- Document role-specific measures that employees can control.

- Set measurable and achievable expectations so outcomes are fair.

- Tie project rewards to milestone quality, timeliness, and stakeholder satisfaction.

Team dynamics and collaboration risks to watch

Incentives can spur helpful effort or create unhealthy competition. Watch for ambiguous goals, inconsistent metrics, or unclear reviews—these are warning signs.

Managers should use calibration and rubrics to reduce bias. Balance individual and team compensation to protect collaboration.

- Pilot the system first to validate assumptions.

- Upskill managers to set fair expectations and document decisions.

- Use transparent criteria to keep employees and the company aligned.

Designing fair performance metrics and scorecards

Designing scorecards begins by asking which outcomes truly move the business forward. Start small: pick 3–5 measures that balance individual and team aims. Keep the questions simple so employees know what matters.

Setting SMART goals and balanced scorecards

Use SMART goals to make expectations concrete. Each goal should be specific, measurable, achievable, relevant, and time-bound.

Create a balanced scorecard that blends financial, operational, quality, and customer metrics. This mix prevents chasing volume at the cost of quality.

Selecting KPIs: revenue, output, quality, and customer satisfaction

Choose KPIs employees can influence. Examples: revenue for sales, output or cycle time for operations, defect rates for quality, and CSAT for service roles.

Aligning metrics to company goals and employee control

Map each metric to a company objective and confirm the employee can affect it. If control is limited, use team-level measures or project gates instead.

Calibration and performance reviews to reduce bias

Run calibration meetings with managers and HR to align standards across teams. Use a mix of manager ratings, peer input, and objective data to make reviews repeatable.

“Document clear evidence standards and timelines so decisions are defensible and consistent.”

- Scorecards: SMART goals + balanced metrics across revenue, productivity, quality, and CSAT.

- Non-discretionary bonuses: tie to pre-defined criteria; reserve discretionary rewards for exceptional contributions.

- Systems: automate data capture, standardize calculations, and keep an audit trail for payouts.

Building your compensation plan and pay mix

Start by deciding how much stability employees need versus how much upside the business can afford. This trade-off shapes base salary and variable components for each role.

Base vs. variable balance: set a higher base for mission-critical or low-visibility roles. Increase variable share where results are clear and within an employee’s control, such as sales or discrete projects.

Plan components made simple

Define eligibility, performance periods, and payout mechanics up front. Spell out caps, pro-ration rules, accelerators, and clawbacks so there are no surprises.

- Eligibility: who qualifies and when (hire dates, probation rules).

- Timelines: quarterly or annual cycles and payout timing.

- Payout mechanics: formulas, thresholds, tiers, and documentation.

Budgeting and value alignment

Budget incentives so the expected uplift outweighs program cost. Model scenarios: best, likely, and worst cases for commissions, bonuses, and profit-sharing distributions.

Tip: Use deferred profit-sharing to boost retention, and combine non-discretionary bonuses for predictability with discretionary awards for one-off contributions.

Systems and audits: automate calculations, keep an audit trail, and link compensation outcomes to SOPs and team productivity via SOPs and team productivity.

Implementation playbook: transparency, compliance, and tools

How you launch a rewards program matters as much as what it rewards. A clear rollout turns theory into consistent outcomes. Start by documenting rules, timelines, and eligibility so everyone knows the expectations.

Communicating expectations, metrics, and rewards clearly

Write plain-language guides that explain what counts, how metrics are measured, and when payouts occur. Share examples so employees see how their work maps to compensation.

- Publish a one-page plan document: eligibility, timelines, formulas, and appeals.

- Run brief town halls and manager Q&A sessions to socialize the plan.

- Send periodic status updates so staff track progress toward rewards in real time.

Preventing bias and favoritism in incentive distribution

Use calibration meetings, structured reviews, and combined manager-plus-peer input to reduce subjectivity. Train managers to evaluate behaviors and results, not personalities.

“Consistent criteria and documented evidence keep similar performance rewarded similarly.”

U.S. compliance considerations across states and cities

Check local laws on pay transparency, overtime calculations, and equal pay. Treat non-discretionary bonus rules carefully when computing the regular rate for overtime.

Tech stack for performance tracking, reviews, and payouts

Choose tools that automate metric capture, store audit trails, and calculate payouts. A central system speeds reviews, supports governance rhythms, and helps your company scale the model.

- Quick rollout steps: document rules, socialize the plan, and publish clear expectations.

- Governance: quarterly checkpoints and an annual plan refresh keep the system aligned.

- Tools: tracking, review workflows, and automated compensation calculations for audits.

Benefits, drawbacks, and mitigation strategies

Good reward plans boost effort by making the link between everyday work and meaningful rewards clear. You’ll see higher motivation, stronger productivity, and better retention when incentives align with realistic goals.

Motivation, productivity, and talent retention upsides

Benefits: Incentive programs can increase job satisfaction and cut turnover and absenteeism. Nearly half of employees—about 46%—cite salary or potential bonuses as their top reason to stay.

When employees know how their efforts map to rewards, they focus on outcomes that move the company forward.

Common pitfalls: stress, unhealthy competition, and quantity over quality

Incentives can backfire. Teams may feel stressed, competition can harm collaboration, and quantity goals can erode quality.

Bias and extra admin work also hurt culture and fairness if you fail to design clear rules and checks.

Mitigations: realistic targets, team bonuses, and ongoing feedback

Set realistic targets using a balanced scorecard that weights quality and customer metrics alongside sales or output.

- Blend individual rewards with team bonuses to protect collaboration.

- Combine manager ratings with peer input and anonymous feedback to reduce bias.

- Use tiered plans and development paths so average employees stay motivated while top performers stretch.

“Use tech to automate tracking and keep an auditable record—this reduces admin burden and improves accuracy.”

Conclusion

Closing the loop between work and reward takes clear rules, fair measurement, and simple tools. Use this guide to pick a model that fits your roles and culture, whether sales, ops, or support.

Start small: pilot a plan, define metrics and goals, and link reviews to transparent payouts. Balance individual upside with team rewards so you can motivate employees while protecting well‑being and quality.

Protect fairness with calibration, bias-aware reviews, and consistent criteria. Automate tracking and calculations to keep an auditable record and save managers time.

With clear metrics, regular feedback, and periodic review, your performance-based compensation and compensation model will evolve to serve your business and your people.