Last Updated on January 13, 2026

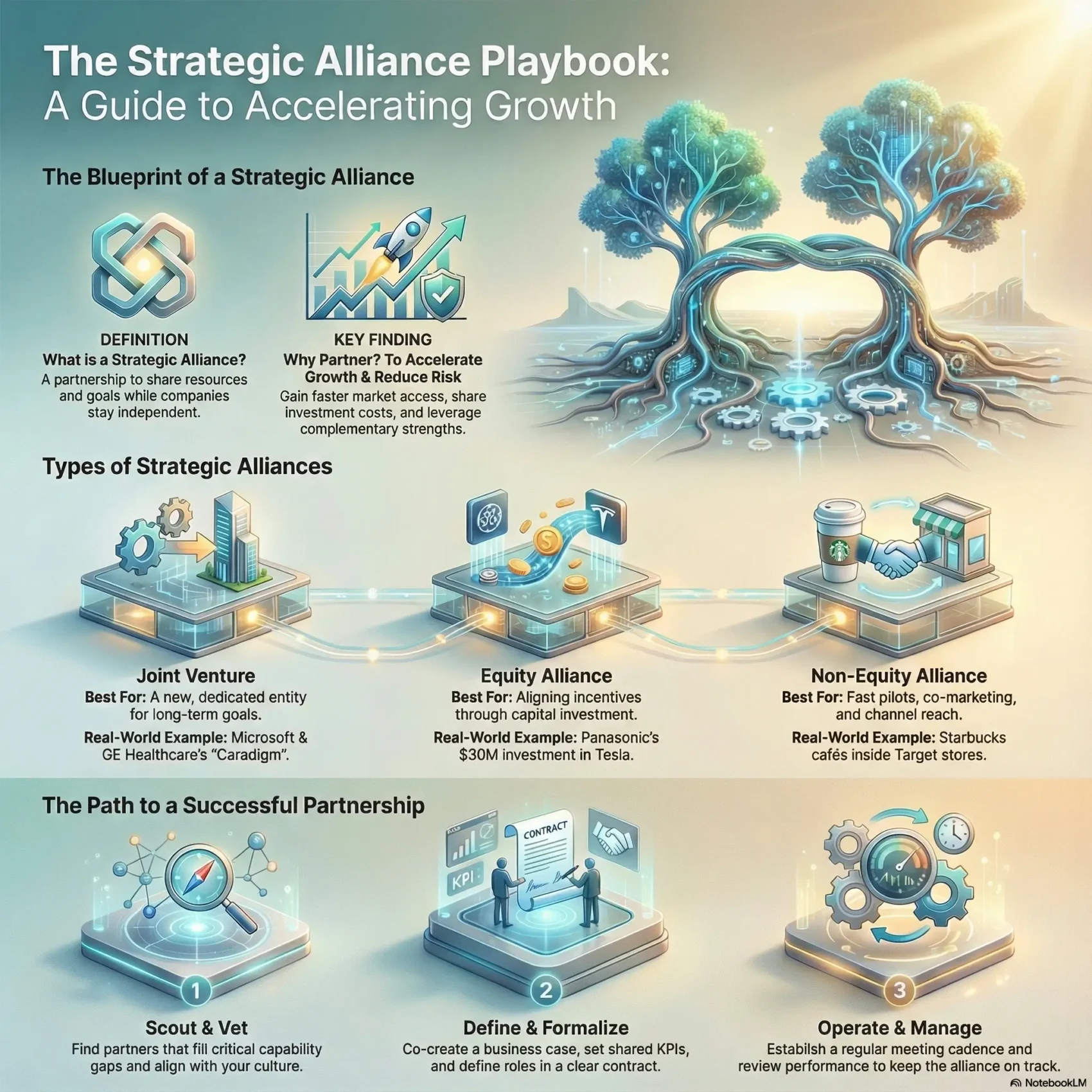

You often face opportunities that a single company can’t capture alone. A strategic alliance brings two companies together as separate entities that share resources to hit joint goals.

This article shows practical examples like Uber + Spotify, Starbucks + Target, and Apple Pay + Mastercard to reveal how clear objectives, trust, and written agreements made each partnership work. You’ll see how an alliance can open new distribution, speed innovation, or add credibility without a merger.

Good planning sets roles, decision rights, and shared metrics up front. That keeps momentum and limits risk. Read on to get a repeatable process for scoping, contracting, and operating an alliance that delivers measurable business outcomes.

Key Takeaways

- Alliances let you share resources with another company while staying independent.

- Clear goals, trust, and written agreements are the core of success.

- Real examples show practical payoffs: distribution, innovation, and credibility.

- Set governance, decision rights, and exit logic before launch.

- Use a repeatable cadence to keep both sides aligned and accountable.

Strategic Alliances: Definition and Core Concepts

Many companies find that teaming up lets them move faster and test new markets without losing their independence.

A strategic alliance is a structured collaboration where two companies agree to share resources and goals while each company stays separate. It is not a merger or an acquisition; governance and balance sheets remain distinct.

Alliances form so you can access expertise, distribution, or regulated services without building them yourself. They speed time to market, diversify revenue, and let you pilot an idea with less full investment.

Common forms include joint ventures (Microsoft and GE Healthcare’s Caradigm), equity deals (Panasonic’s investment in Tesla), and non-equity collaborations (Starbucks cafés inside Barnes & Noble). Each form balances control, risk, and rewards differently.

“A clear contract defines scope, IP, data use, deliverables, and exit terms.”

- Defines shared value and measurable outcomes

- Keeps brands and governance separate

- Provides a bridge to customers and services you don’t yet reach

What Makes an Alliance Truly Strategic

Not every partnership moves the needle; the truly impactful ones meet very specific tests. Use clear criteria so you fund and run only the alliances that matter to your core work.

Five criteria that separate conventional from high-impact deals

- Core objective criticality: The deal must be essential to a primary business goal like revenue growth or cost leadership.

- Competency building: It should help you learn or defend a core capability, often via learning with a partner.

- Threat blocking: The alliance can prevent a rival from gaining an unfair route to your market.

- Future options: It must create or preserve paths for expansion or exit in the future.

- Risk mitigation: The tie-up should reduce key risks, for example by dual sourcing or co-development.

Aligning expectations and core objectives

Translate goals into shared metrics that are time-bound and have named owners on both sides. That keeps both companies accountable.

“Shared metrics, executive sponsorship, and formal governance increase success rates.”

- Secure executive sponsors to give the alliance visibility and budget.

- Run recurring leadership forums to build trust and surface issues early.

- Assess fit beyond numbers: look at culture, decision speed, and how each partner keeps commitments under pressure.

Types of Strategic Alliances and When to Use Each

Choosing the right deal shapes control, speed, and capital needs. You decide whether to launch a new entity, take an ownership stake, or contract for services based on market fit and risk.

Joint ventures: creating a new entity for shared goals

Joint venture fits when both companies need a distinct brand, P&L, and long-term governance. Think of Microsoft and GE Healthcare’s Caradigm — a 50/50 JV built for a health platform that later changed hands as the market evolved.

Equity alliances: investing to accelerate advantage

Equity works when capital signals commitment and aligns incentives. Panasonic’s $30M investment in Tesla jump-started battery collaboration and helped speed EV innovation.

Non-equity alliances: sharing resources without ownership

Use a non-equity strategic deal for fast pilots, channel reach, or co-marketing. Starbucks cafés inside Barnes & Noble show how two companies can combine operations and audiences without an ownership swap.

Choosing the right structure

- Match type to regulation, IP, and capital intensity.

- Define how resources, products, and services flow.

- Map decision rights and exit scenarios up front.

“Pick the structure that fits your market, not the one that feels familiar.”

Benefits, Risks, and Trade-offs You Should Weigh

Weighing benefits and trade-offs helps you decide if a tie-up will truly speed your market progress. Look at faster entry, revenue diversity, and brand lift alongside coordination costs and reputation exposure.

Access to new markets and customers often comes fastest through a partner with a ready base. You may also gain capabilities that would take years to build, so you test offers and prove value with co-created experiences before full rollout.

Shared risk and diversified revenue reduce the burden on any one company. A well-structured alliance spreads investment and shortens sales cycles by leveraging halo effects from a respected brand.

But collaboration costs are real: PMO overhead, integration work, and potential conflict over priorities can slow you down. Contracts should define obligations, service levels, IP, and remedies if a partner falls short.

“Use pilots and stage gates to validate market assumptions before scaling.”

- You gain access new audiences and capabilities faster than building alone.

- You share investment risk and diversify business revenue streams.

- You must manage imbalance of benefits and guard reputation with clear review rights and crisis clauses.

- Set measurable targets for market penetration, customer adoption, and value creation, and check progress regularly.

How to Choose the Right Partner and Set Clear Objectives

Picking the right partner starts with a clear map of the gaps you need to close and the strengths you lack. Translate your goal into capabilities—distribution, data, manufacturing, or compliance—and target partners that fill those gaps.

Map goals to partner strengths:

- List capability gaps and rank them by impact on the business.

- Vet cultural fit, risk tolerance, and decision speed so the alliance moves fast.

- Quantify mutual value—market reach, marketing efficiency, and support savings.

Define governance and exit scenarios upfront:

- Set shared KPIs, named owners, and a review cadence to keep momentum.

- Document steering committee roles, escalation paths, and change control.

- Agree on data rights, IP, brand rules, and wind-down timelines before launch.

Run a pilot to validate assumptions, confirm resourcing, and scale by performance signals. Strong communication and trust will keep your alliance on course.

Steps to Build and Run a Successful Strategic Alliance

Follow a clear, repeatable set of steps to turn a partnership idea into a live program that delivers measurable business outcomes.

Scouting and vetting potential partners

You map your roadmap to outside capabilities and shortlist companies with credible track records serving the same customers.

Co-creating the business case and success metrics

Work with your partner to outline revenue impact, cost to serve, and the resources each side will commit.

Formalizing the agreement, roles, and decision rights

Lock in legal terms that cover milestones, SLAs, IP, brand use, and termination triggers so the alliance can move fast without surprises.

Operating cadence and performance management

Set an operating rhythm: joint working groups, weekly standups, and a quarterly steering committee with executive sponsorship.

- Define a shared KPI stack—adoption, retention, pipeline, and NPS—with named owners.

- Launch a pilot, iterate on feedback for products and services, then scale by channels.

- Integrate marketing—positioning, demand gen, field enablement, and PR—to align the story.

“Use shared dashboards and retrospectives to optimize investment where performance exceeds plan.”

Real-World Strategic Alliance Examples That Work

D

When companies match audiences and capabilities, you get clear, repeatable wins. Below are compact case studies you can model for your own deals.

Uber + Spotify

Customer experience was the focus: riders streamed personal playlists during trips. That feature boosted engagement and gave each company cross-exposure to large user bases.

Starbucks with Target and Barnes & Noble

Co-located cafés increased dwell time and basket size in retail stores. Starbucks’ presence inside Target and Barnes Noble kept foot traffic flowing and helped both companies reach habitual customers.

Disney + Chevrolet

The Test Track at EPCOT let guests design virtual cars, then experience a high-speed ride and see Chevrolet models after. That co-creation tied brand storytelling to a tangible product experience.

Red Bull + GoPro

They built a content engine. POV footage from extreme events amplified community buzz and positioned both brands as category leaders in adventure and media.

Apple Pay + Mastercard

Launching contactless payments together gave Apple early trust and scale. The card partnership later extended to additional offerings, speeding market adoption.

These alliance examples show how shared audiences, complementary capabilities, and joint storytelling open new markets fast.

For ideas on bringing partner channels together in your programs, see omnichannel strategies.

Conclusion

,

The lessons here show how a well-run partnership turns shared work into measurable market gains.

What you take away: pick partners who solve real gaps, pick the right deal type—from joint venture to equity or a non-ownership tie—and set clear metrics and named owners before launch.

Run a small pilot, stand up governance, and publish a review cadence so the relationship adapts as markets change. Protect your brand with crisp legal rules and build mechanisms to renegotiate when needed.

Do this and your company will access new customers, learn faster, and create long-term value from each alliance. Your next step: shortlist targets, sketch the value case, and pilot with tight scope.