Last Updated on February 9, 2026

You need a clear way to set the right price at the right time. This introduction explains how dynamic pricing helps businesses respond to changing market conditions and real-time demand. Online sellers update prices instantly, which lets companies protect margins and grow revenue.

Major companies adjust prices thousands of times a day using algorithms that read data on stock, visits, competitor moves, and time of day. When you use dynamic pricing, you tap into signals that show what customers value now.

Across e-commerce, omnichannel, and time-sensitive categories, this method helps you act fast without losing trust. Later sections will show how to combine cost, competitor, and value-based approaches into a simple, scalable strategy that keeps customers informed and your team aligned.

Key Takeaways

- Dynamic pricing adapts prices to demand and market signals to boost revenue.

- Real-time data lets companies react quickly to competitor moves and trends.

- Combine cost, competitor, and value rules to build a resilient pricing strategy.

- Communicate changes clearly so customers feel informed, not surprised.

- Start in high-impact categories and scale with governance and testing.

Why You Should Care Now: Market conditions, consumer behavior, and real-time competition

E-commerce makes it possible to tune offers on the fly based on live demand and supply signals. That speed changes how you win customers and protect margins in a fast-moving market.

Your search intent decoded: how to use dynamic pricing to grow revenue without losing trust

You want higher sales and smarter margins while keeping customers confident. When you use dynamic pricing with clear guardrails, you can raise conversions and average order value—some teams report up to a 13% lift during peaks.

Present-day pressures in the United States market

Retailers like Walmart and Amazon update prices within minutes when stock shifts. That puts pressure on mid-size businesses to react without starting a price war.

- You shop across tabs; customers compare and expect fair value.

- Seasonal demand, events, and local trends change demand fast.

- Map goals (revenue, sales velocity, cash flow) to clear rules so your team stays in control.

In short: adopt well-defined, transparent rules to capture upside during peaks and avoid over-discounting in slow periods.

Dynamic pricing, defined: how prices adapt to demand, supply, and competitor prices

Prices shift when demand, stock, and outside events change — and your systems can follow that signal automatically.

What it is (and what it isn’t)

Dynamic pricing continuously adjusts prices based on demand, seasonality, inventory, and set price bounds. It uses market signals and rules so changes match how fast your category moves.

It is not the same as arbitrary or secret markup. The goal is clear, repeatable updates that protect margin and customer trust.

How it differs from personalized offers

Personalized pricing tailors a price to someone using personal behavior and profile data. That method raises privacy and fairness questions.

By contrast, your model can be market-responsive rather than consumer-specific. That keeps customers feeling treated fairly.

Where it works best

- E-commerce and omnichannel sellers where products and stock change fast.

- Time-sensitive categories like electronics, toys, and event tickets.

- Stores using electronic shelf labels to sync online and in-store prices.

Data and AI foundations: the pricing model behind real-time decisions

You need clean inputs and clear rules before you adjust prices in real time. Start by collecting traffic, orders, inventory, and competitor prices. Add seasonality, weather, events, and macro indicators so your model sees the full picture.

Core inputs that drive better outcomes

Map demand signals first. Use site visits and conversion rates alongside order velocity to infer short-term demand.

Track live inventory and supply health to avoid oversells. Feed competitor prices and local events into monitoring so you react, not overreact.

How machine learning, elasticity, and rules engines work together

Combine a rules engine for floors and ceilings with ML that estimates elasticity from historical and real-time data.

The model forecasts demand and suggests price moves. Your rules keep brand positioning and margin intact.

Systems integration and operational controls

Integrate POS, ERP, and e‑commerce software so price changes respect stock and fulfillment limits.

Instrument change logs, approval flows, and alerts to catch anomalies before they reach customers.

- Feed diverse data sources—browsing, sales, inventory, events—into one model.

- Use guardrails plus elasticity estimates to adjust prices without eroding trust.

- Make sure your systems sync so market changes don’t create operational errors.

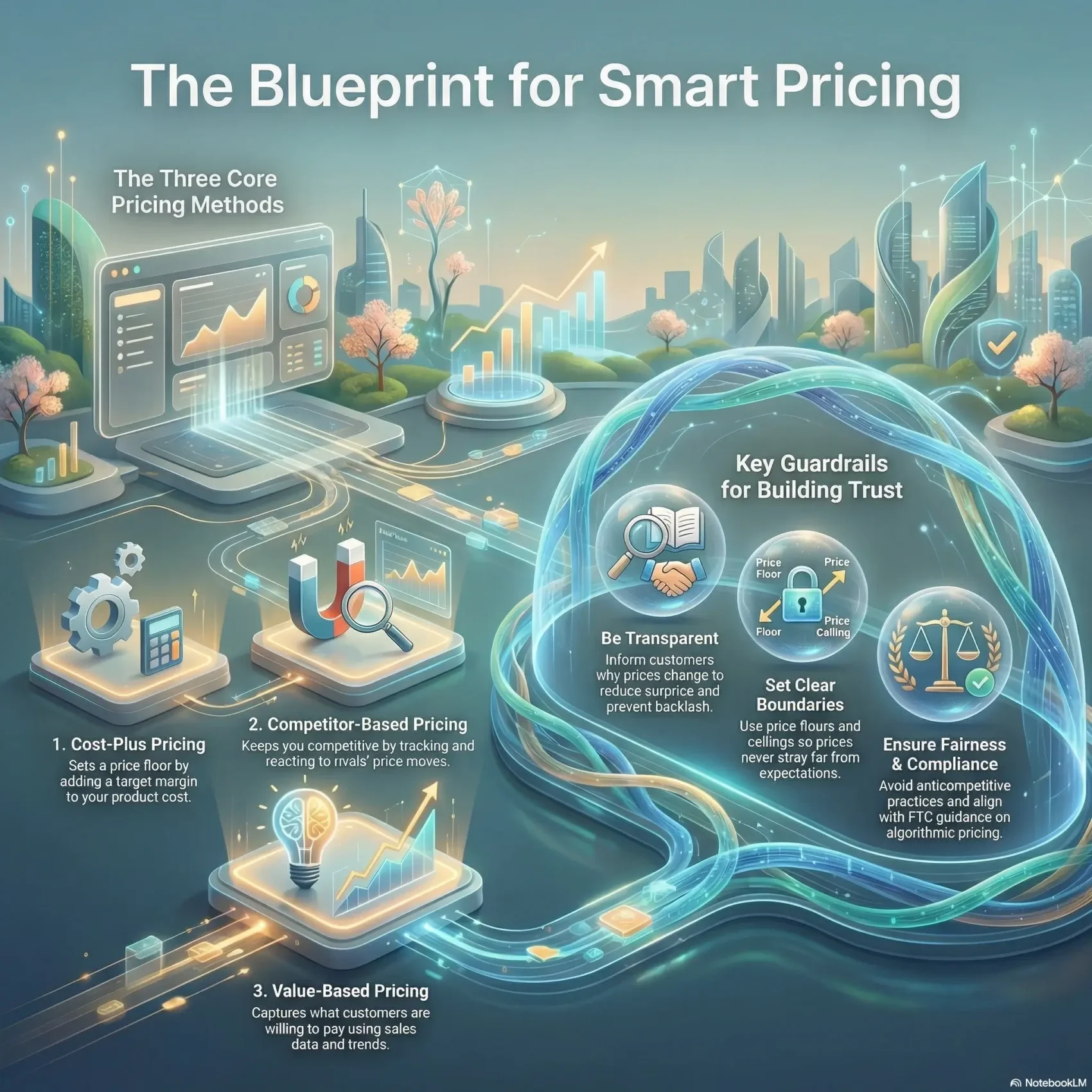

The essential pricing methods you’ll combine

Combine proven cost rules with market and value signals so your prices work for profit and perception.

Start with three clear methods:

Cost-plus, competitor-based, and value-based methods

Cost-plus locks a floor: set price = cost + target margin. This protects profitability for low-margin items.

Competitor-based rules keep you visible in the market by tracking rival prices and deciding when to match, beat, or hold.

Value-based pricing captures customer willingness to pay by using sales history, ratings, and external data to estimate elasticity.

Blended approaches inside modern pricing systems

Blend methods with clear weights and fallbacks. Use cost-plus to secure margins, add competitor signals for market fit, and layer value insights to capture upside.

“Use rules to set floors and ceilings; let the model suggest increments between them.”

- Weight methods by category, season, and lifecycle stage.

- Set exception rules for flagship items, subscription add-ons, and long-tail products.

- Include signals like stock level, popularity score, and simple weather inputs to refine outcomes.

Report by method. Attribute wins to cost, competitor, or value inputs so you can tune the model and keep your team aligned.

Dynamic pricing strategies you can deploy today

Start with clear, testable tactics that match how your market and customers behave. Use calendar rules for expected peaks, triggers for demand swings, and inventory rules to manage stock.

Time-based and peak pricing for predictable cycles

Start with scheduled windows for weekends, holidays, and season openings. Set gentle increases during high-demand hours and automate rollbacks after the window ends.

Demand-based and inventory-driven tactics

Set triggers that raise prices when traffic and conversion climb. Use inventory rules to clear slow movers or slow sales when stock is low.

Geo-pricing and local competition

Vary offers by region to reflect competitor prices, local supply, and purchasing power while keeping core brand value consistent.

Personalized offers without eroding brand value

Reward loyal customers with coupons, bundles, or loyalty credits. Guardrails and clear caps prevent unfair gaps and preserve trust.

“Limit how far and how fast prices move—small, tested steps reduce customer surprise.”

- Use ESLs to keep online and in-store prices aligned.

- Run A/B tests by category to measure revenue, velocity, and margin.

Industry examples and playbooks you can borrow

Learn from real firms that run live price programs and borrow the mechanics that match your goals.

Amazon updates prices at scale—about 2.5 million changes per day—using demand, stock, competitor signals, and page views. That model shows how automation pairs with rules to protect margin.

How platforms balance supply and demand

Uber uses surge fares to attract drivers where demand peaks; fares fall back as supply returns. This is a clean example of short-term market balancing.

Capacity-led playbooks

Airlines pioneered yield management: fares move by season, time to departure, and remaining seats. Use advance windows and inventory bands for products with limited capacity.

Guardrails and host control

Airbnb auto-adjusts by season and location while letting hosts set minimums. That mix keeps hosts protected and market responsiveness intact.

SaaS models

Adopt tiered or usage-based plans and pair them with monetization software like Paddle/ProfitWell to track growth and churn.

- Translate each example into concrete rules—index competitors, set floors/ceilings, and cap hourly moves.

- Watch for inventory mismatches and approval flows to avoid customer surprise.

- Give your team clear alerts and a review cadence before full rollout.

Business impact: revenue, sales, and inventory management wins

When you tie price moves to live demand and stock signals, the measurable gains show up fast. Practitioners report lifts in average order value of up to 13% during peaks when rules are tuned well. You can protect margin while capturing short windows of higher willingness to pay.

Lift in average order value and margin optimization

Small, data-driven price changes increase basket size and margin. Use elasticity estimates to nudge prices up on high-converting items and widen margin where customers tolerate it.

Measure AOV and margin by cohort so you can prove wins and iterate quickly.

Clearing slow movers and reducing overstock

Targeted discounts on underperforming items move inventory without deep, sitewide markdowns. Teams report a 6% reduction in overstock in a quarter by pacing sales and lowering prices tactically.

That keeps cash flowing and inventory turns healthy while preserving the value of fast movers.

Staying competitive without racing to the bottom

Use competitor-aware rules to react selectively instead of blanket markdowns. This keeps your brand value intact and avoids training customers to wait for constant sales.

“Real-time competitor monitoring lets you stay strategic, not reactive.”

- Quantify impact: tie price moves to revenue, sales velocity, and inventory KPIs.

- Trade-offs: know when to favor speed over margin and when to hold price for lifetime value.

- Guardrails: set thresholds to stop overcorrection in slow periods and keep customer trust.

For a practical playbook on aligning revenue and ops, see RevOps business trends. Use your data to detect price drift early and report wins to stakeholders with clear, repeatable metrics.

Risks, pitfalls, and brand safeguards

When price moves outpace explanation, you risk customer trust. Rapid shifts can look opportunistic and cause a public backlash. One well-known example: Ticketmaster’s surge led to midrange Bruce Springsteen seats topping $4,000 and harmed brand perception.

Manage risk by combining rules, transparency, and checks that protect your value. Below are clear steps to prevent common failures and fix them fast.

Customer backlash and how to avoid it

Keep moves small and explain why you change a price. Changes under 5% are often unnoticed; aggressive swings trigger complaints.

Use simple messaging at checkout and on product pages to show the value behind a change. That reduces support volume and keeps buyers calm.

The PRICES approach to set ranges, thresholds, and transparency

PRICES sets practical guardrails you can apply today:

- Pause large moves for frequent-purchase items.

- Set clear floors and ceilings so prices never stray far from expectations.

- Inform customers with short, honest copy explaining why a price changed.

- Use conservative thresholds and staged decreases to protect brand value.

When algorithms go wrong: alignment with inventory and data quality

Misaligned feeds can create wildly wrong prices and wipe margin gains. Sync your ERP and order systems before automation scales.

Build alerts for outliers and manual review steps so a person can stop a bad change. Have a rollback plan and prepped customer messaging for incidents.

“Design alerts and manual checks to catch outlier prices before they reach customers.”

Legal and ethical guardrails in the U.S. today

Regulators and courts are paying closer attention to how algorithms shape what consumers pay. You must design your program to meet new enforcement expectations and public norms.

FTC focus on algorithmic pricing, price discrimination, and deceptive fees (2024–2025)

In 2024 the FTC opened an inquiry into “surveillance pricing,” looking at how AI, consumer data, and competitor inputs affect prices. The agency also revived a Robinson-Patman Act case, signaling concern about discriminatory conduct.

The May 12, 2025 Rule on Unfair or Deceptive Fees now bans bait-and-switch tactics and demands total price disclosure for live events and short-term lodging. States are proposing bills on data-driven pricing and discrimination.

Transparency, fairness, and avoiding anticompetitive practices

Be transparent: disclose fees and show total cost early in checkout. Limit use of personal data and offer opt-outs where reasonable.

Avoid collusion: keep independent decision logs so you can prove moves weren’t coordinated with competitors.

Policy choices: no-surge commitments and audit trails

Consider formal no-surge commitments for emergencies and enforce them with alerts. Maintain audit trails, change logs, and approvals that record which data and rules set each price.

“Record how prices were set, by which data, and under what rules.”

- Map FTC posture to your compliance program and update policies.

- Assess privacy limits: minimization, purpose bounds, and opt-outs.

- Build an audit checklist to review fairness, transparency, and anti-collusion risks.

Choosing dynamic pricing software and systems

Choose software that watches the market and your stock with the cadence your business needs.

Key selection criteria: monitor frequency, API latency, accuracy, and integrations. You want short API response times for fast updates and reliable monitoring to avoid price mismatches.

Tooling landscape for retailers

Different tools fit different retailers. Prisync suits SMBs and mid-market stores with 100–5,000 SKUs for competitor tracking and automated repricing.

Wiser Solutions targets enterprise teams with 100,000+ SKUs and deep integrations. Intelligems focuses on Shopify A/B testing and price experiments.

What to check in an RFP

Align stakeholders by listing goals, scale, and governance. Ask vendors about data pipelines, quality controls, and fallback behavior when feeds fail.

Evaluate the pricing model fit: rule-based, ML-assisted, or hybrid, and map that choice to your approval flows and learning curve.

“You’ll avoid surprises when monitoring, integrations, and rollback plans are clear.”

- Vendor checklist: monitoring frequency, API latency, accuracy, and historical data retention.

- Integrations: ERP, POS, e‑commerce, and analytics so prices reflect real stock and demand.

- Plan: phased rollout, training, and success metrics so the investment scales with your businesses’ needs.

How to implement dynamic pricing strategies

Begin by setting one clear business goal—revenue, margin, or cash flow—and let that target guide every price change. A focused objective keeps experiments small and measurable so you can learn fast.

Define goals and success metrics

Decide the KPI you will track: revenue growth, sales velocity, or inventory turns. Tie each metric to an attribution plan so you can credit price moves for results.

Translate objectives into pricing rules and boundaries

Turn goals into concrete rules: floors, ceilings, and threshold triggers. Map exception logic for hero SKUs and promotions to protect brand value.

Start small, test, and expand by product and channel

Begin with a limited product group and one channel. Run short A/B tests over set time windows. Measure impact, then expand where you see clear lift.

Omnichannel execution: ESLs and online parity

Coordinate in-store and online updates. Use electronic shelf labels and synced APIs so your systems reflect inventory and site changes at the same cadence. Train teams, set approvals, and build alerts to catch feed drift before customers notice.

“Start small, measure clearly, and scale only after you prove the play works operationally.”

- Set measurable goals and attribution rules.

- Convert goals into floors, ceilings, and exceptions.

- Test by product group and expand by channel.

- Use ESLs and integrated systems to keep parity and protect customers.

Measure, monitor, and optimize in real time

Set clear, measurable alerts so you spot price drift before customers notice. Good measurement keeps your program stable and helps you prove impact. Machine learning improves as your systems gather more data, making elasticity estimates more accurate over time.

KPIs to track: revenue, margin, price index, conversion, and inventory turns

Pick a few core metrics and report them daily. Track revenue and margin by cohort. Compare your price index to the market and watch conversion and inventory turns to see how moves affect sales.

Elasticity learning loops and competitive trend monitoring

Run continuous learning loops that update elasticity as new sales and visit data arrive. Monitor competitors and broader trends, but filter short-lived noise so you react to real signals.

Governance cadence: reviews, exceptions, and continuous tuning

- Define dashboards and real-time alerts for anomalies.

- Hold weekly reviews, approve exceptions, and recalibrate rules quarterly.

- Use A/B and holdback tests to isolate the effect of price moves from promotions and seasonality.

“Instrument, test, and govern—then scale what proves repeatable.”

Conclusion

,Practical rules and clear guardrails help you unlock revenue while keeping brand trust intact. Use dynamic pricing as a tool that links demand, market signals, and quality data so you can act fast and measure results.

Keep customers at the center: explain why prices changed, set sensible ranges, and avoid sharp moves on everyday items. Blend cost-plus, competitor-aware, and value inputs into a single pricing approach that matches your products and goals.

Start small with pilot products, pick software that integrates inventory and competitor feeds, and document decisions. Stay compliant with FTC guidance, update guardrails, and review results often so your business grows revenue, improves sales, and keeps customers confident.