You’re seeing a fast shift in how shoppers pay. Buy now, pay later lets your customers split purchases into interest-free installments while you receive the full payment upfront, minus provider fees. This model has grown quickly — 15% of Americans used it in 2024 and transaction volume topped $309.2 billion in 2023.

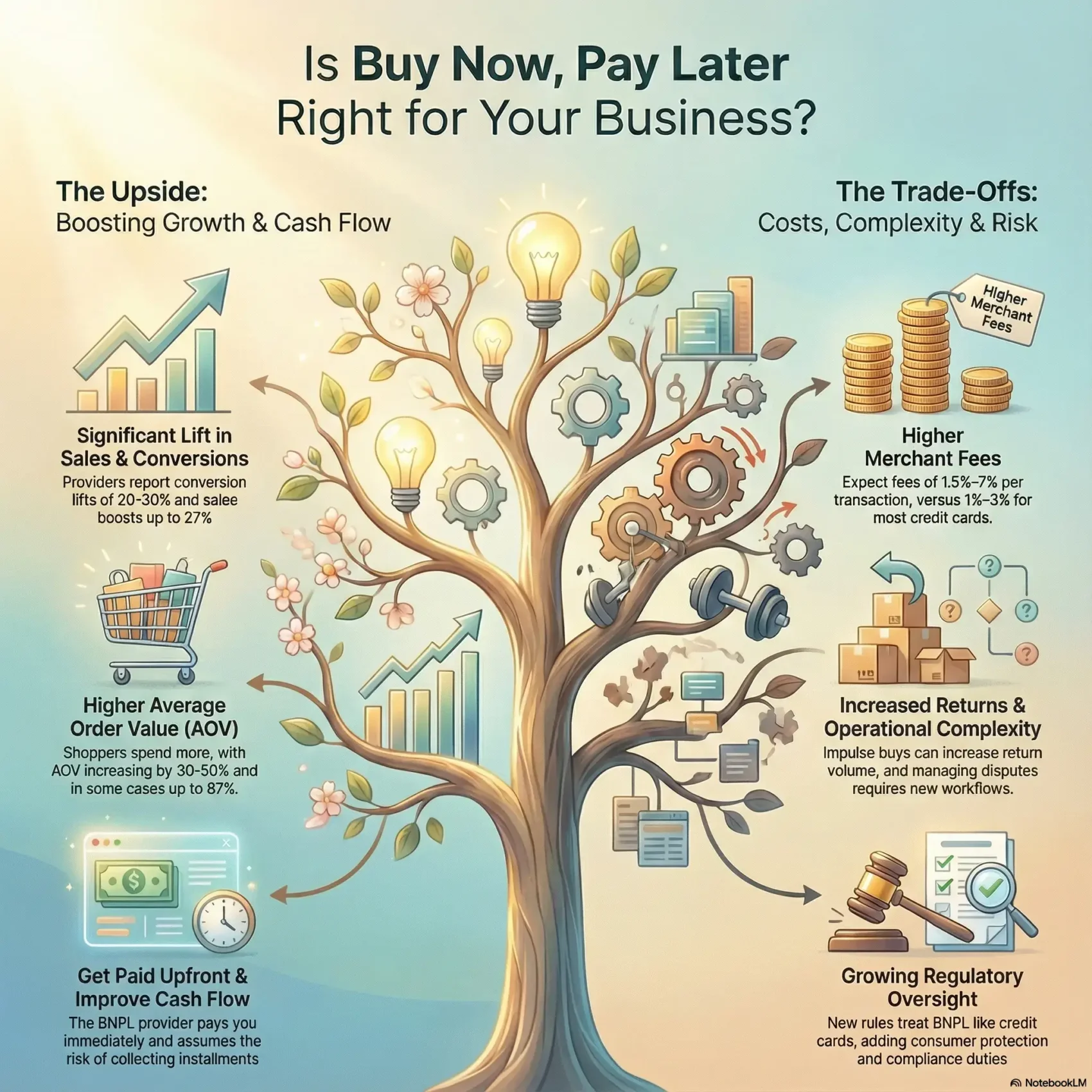

Providers report notable gains: some merchants see a 20% lift in conversions, up to 87% higher average order values, and Stripe has cited a 27% sales boost. At the same time, fees and returns add new costs you must weigh.

This introduction previews what you’ll learn: how pay later works at checkout, why adoption matters for your retail strategy now, and how the payment timing shifts your cash flow and operations. The guide lays out pros and cons, benchmarks, and practical steps to decide if adding this option fits your margins and customers.

Key Takeaways

- Buy now, pay later can increase conversions and basket sizes, with measurable uplifts reported by providers.

- Adoption is high in the U.S.; transaction volume rose sharply from 2023 to projected 2024 figures.

- You get paid immediately while installment collection transfers to the provider, changing cash flow timing.

- Expect trade-offs: higher provider fees, returns complexity, and reputational risk to manage.

- Align pay later with your margin structure, customer expectations, and checkout flow before launching.

What BNPL means for you right now

Letting shoppers spread payments over weeks turns hesitation into a quick decision to buy.

How it works: Many programs split a purchase into interest-free installments over 6–8 weeks. Providers like Klarna, Afterpay, and Affirm handle instant approval, payment collection, and default risk while you receive funds up front.

Why flexible installments change buying behavior

You remove the biggest barrier to purchase: a high upfront total. Flexible installments give customers predictability and control, so discretionary purchases convert more often.

- You avoid chasing payments because the service handles approvals and collections.

- Price-sensitive shoppers will often choose to buy when a $200 cart can be split into four easy payments.

- You keep immediate liquidity, so you can restock and fulfill without straining cash flow.

BNPL business impact: the upside you can tap into

When you offer installments at checkout, you often see clear gains in order volume and average ticket size.

Real results matter: Stripe reports a 27% uplift in sales volume for shops that accept pay later options. Affirm notes roughly a 20% conversion increase and an 87% jump in average order value for retailers using its service. Other market estimates place conversion lifts between 20%–30% with ticket sizes rising by 30%–50%.

Conversion lift and sales growth you can actually measure

You can quantify the upside. Add a pay later button and many stores see measurable growth in sales and conversion within weeks.

- You’ll likely increase average order as shoppers add items or trade up when totals are split into manageable payments.

- You gain customers who avoid or don’t qualify for cards, expanding reach without changing products.

- The provider pays merchants up front (minus fees), so your cash flow stays steady while payments are collected externally.

The trade-offs: costs, complexity, and reputation risks

Convenient payment plans often hide added fees and service friction that merchants must manage.

Higher merchant fees versus credit and debit cards

Expect acceptance fees of roughly 1.5%–7% per transaction, versus about 1%–3% for most debit and credit card payments.

This can compress margins quickly unless you adjust pricing or promotions to cover the difference.

Returns, disputes, and who owns the customer experience

Returns are expensive: processing a return can average about 66% of the product price.

Impulse purchases fueled by a pay later option may raise return volume and add real costs to your P&L.

“Customers often contact the merchant first for questions, even when the provider handles collections.”

You’ll need clear roles and scripts for returns, disputes, and late-payment inquiries so your team answers consistently.

Operational overhead from integrations and accreditation

Implementation takes time: sandbox testing, accreditation, and reconciliation work are required.

Pick providers with native plugins for your platform to cut setup time and reduce operational overhead.

- You should expect higher acceptance fees than cards; plan pricing to offset them.

- Set tight return and restocking policies to control costs from impulse buys.

- Standardize reconciliation reports and update service playbooks to match new refund timing.

- Monitor fee structures and settlement timelines across providers to find the best fit for your margins.

By the numbers: average order value and conversion rates with BNPL

You can use provider benchmarks to model how an installment option may change your revenue. Translate reported lifts into forecasts and test assumptions against your funnel.

From AOV boosts to cart-abandonment reductions

Real-world data is clear: Affirm customers saw ~20% higher conversions and an 87% jump in average order value. Stripe reports ~27% incremental sales uplift, and Klarna cites up to 30% better checkout conversion.

That means you’ll likely reduce cart abandonment on higher-ticket purchases when shoppers see smaller installments instead of one total.

Benchmarks from providers and payment networks

- Use 20%–30% as a reference range for conversion rates improvement.

- Model ticket increases of 30%–50% to estimate average order effects.

- Tag sessions to measure downstream metrics: return rates, repeat purchases, and NPS.

When a higher purchase amount actually increases order value

“When the purchase amount rises modestly, installments often soften the perceived pain and encourage upgrades.”

Practical step: A/B test providers and set minimum/maximum thresholds so the option drives value without cannibalizing low-ticket sales.

Is BNPL a fit for your products, price points, and customers?

Assess whether your usual purchase amount lands where installments actually increase conversions. Industry guidance shows the sweet spot for many merchants is roughly $50–$500. In that range, installment payments feel accessible and declines stay low.

Who adopts most: Millennials and Gen Z lead usage—over 26% of millennials and about 11% of Gen Z have used these programs for an online purchase. If your customer mix skews younger, uptake and sales lifts can be faster.

- Map your catalog to spot which product categories and bundles raise perceived value.

- Set sensible minimums so very low average order transactions don’t route to pay later.

- Test thresholds and messaging to see how acceptance rates and order size change.

- Track conversion curves and return rates by price band to validate fit.

- Adapt product pages to show installment amounts and nudge hesitant customers.

You can also use deeper customer signals to refine placement. For example, link checkout experiments to your analytics and see which segments respond best. If you want structured data on shopper behavior, consider adding behavioral analytics to measure where pay later truly drives more purchases without eroding margins.

Choosing a BNPL provider and payment option strategy

Choosing the right partner starts with clear metrics, not brand hype. Focus on approval rates, fee tiers, and the end-to-end customer experience before you sign on.

Evaluating providers: approval rates, fees, and customer experience

Compare real performance. Leading names—Klarna, Afterpay, and Affirm—use different approval logic, fees, and settlement timelines.

Ask for sample approval and decline rates for your audience. Request reporting on disputes, refunds, and average settlement days.

How providers compare with credit cards at checkout

Installment services often charge higher fees than credit cards, but they can lift conversion and average order value.

Run pilots to weigh higher fees against net gains in revenue and margin before expanding.

Integrations, data visibility, and your tech stack

Check integration fit: native plugins, gateway compatibility, and OMS/ERP workflows matter for refunds and reconciliation.

- Validate the quality of reporting and what customer-level data the provider shares.

- Confirm settlement timing and partial-refund handling with finance.

- Negotiate fee tiers and marketing support as volume grows.

“Document where the payment option appears and whether you’ll offer more than one provider.”

Implementing BNPL without breaking your margins

Before you roll out installments sitewide, run a narrow financial test to see if the math actually works for you. A targeted trial on a few SKUs shows whether higher conversion and increase average order offset added fees and return costs.

Run the math: fees, conversion rates, and breakeven scenarios

Fees often range from 1.5%–7% per transaction, higher than typical card fees. Build a breakeven model that weights expected conversion lifts of 20%–30% and average order value gains against those fees and return rates.

Include: settlement timing, refund handling, and the ~66% cost on returned product value when you forecast net profit.

Pilot first: start small, monitor returns and satisfaction

Run a time-boxed pilot on select categories. Track return rates, NPS, and support volume so you validate unit economics before scaling.

- Set minimum order thresholds and exclude high-return items.

- Measure how on-site messaging changes conversion and order value.

- Remember providers settle funds up front, which helps cash flow during pilots.

Train your team for BNPL-related service and policies

Align finance and ops on how payments settle, how partial refunds work, and reconciliation across payment methods. Train CX staff on schedules, exchanges, and dispute scripts so customers get consistent answers.

Review provider performance monthly — approval rates, fees, and customer satisfaction — and negotiate terms as volume grows.

For product-level signals and behavioral insights, add behavioral analytics to see where pay later actually lifts conversion without eroding margin.

Regulatory momentum you should watch in the U.S. market

A May 2024 CFPB decision signals tighter oversight and new paperwork for pay-later services and their partners.

The bureau said lenders that offer installment credit will be treated like credit card providers under the Truth in Lending Act and Regulation Z. That expands consumer protections such as dispute rights, clearer disclosures, and standard billing statements.

What this means for you: expect new rules for refunds, billing, and error resolution that require coordination with your providers. Your payments and accounting teams will need updated workflows and documentation.

How to prepare now

- Update your on-site language and post-purchase scripts to reflect card-like consumer rights.

- Review how refunds and chargebacks are processed so your teams meet new timing and reporting needs.

- Watch for changes in acceptance policies and rates as providers adjust to compliance costs.

- Prioritize partners with strong compliance and clear data reporting so you can reconcile statements cleanly.

“Standardized disclosures and dispute processes will likely change how refunds and billing are handled between merchants and providers.”

Conclusion

You can treat installments as a measured tool to nudge sales while protecting margins. Many U.S. businesses report conversion lifts of 20%–30% and higher average order values, though fees remain higher than for credit cards.

Run pilots, model breakeven points, and use real results to decide where to expand. Optimize product and cart messaging to increase average order without exposing low-margin items to extra costs.

Train teams, tighten return and dispute workflows, and choose providers that match your stack and company priorities for data and support. Stay current on CFPB rule changes that align pay-later lenders with TILA/Reg Z so your disclosures and service match customer expectations.

Treat this payment option as one lever in retail growth: test, measure, and iterate to capture value while protecting profit.