Last Updated on December 15, 2025

More than 50 countries now offer remote-work programs that let you live and work abroad for months at a time. Since 2020, remote work grew fast and became a lasting choice for many workers, and governments responded with new visa options to attract talent and tourism.

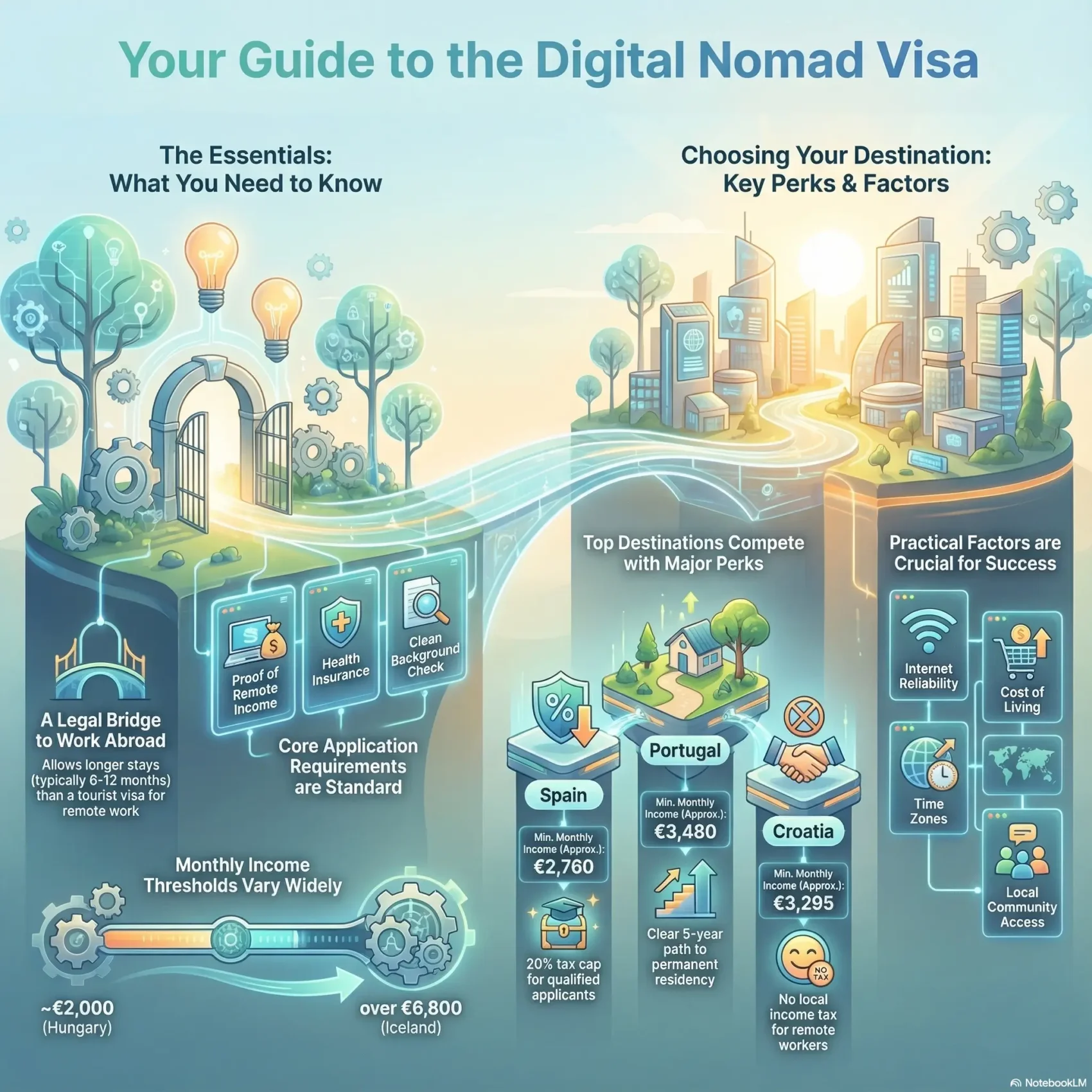

These programs often let you stay longer than a tourist permit and can include perks like lower tax rates or fast processing. Examples include Croatia’s local tax breaks, Dubai’s income tax advantage, and Greece’s partial tax relief for several years.

You’ll get a clear snapshot of how countries design nomad visa rules in 2025, what income and insurance requirements usually look like, and key costs to budget. This intro sets the stage so you can compare visa lengths, renewal paths, and the practical factors that matter when choosing your next base.

Key Takeaways

- You’ll learn how governments tailor digital nomad visas to attract remote workers.

- Typical programs offer 6–12 month stays with renewal options.

- Income proof, health insurance, and clean applications are common requirements.

- Some countries offer tax breaks or exemptions that change overall cost.

- Pick a base by weighing internet, safety, healthcare, and time zone fit.

Why digital nomad visas are surging in 2025

By 2025 the shift that began in 2020 has settled into a new normal: many workers now want long-term mobility. Countries answered by creating or refining programs that let you legally live and work abroad for months or years.

From pandemic shift to permanent remote work

The pandemic proved that a lot of jobs can be location-flexible. Employers kept flexible policies and more people chose to work from abroad. That steady demand pushed governments to build clear requirements like minimum income thresholds, health insurance, and robust application rules.

How countries use visas to attract talent and boost local economies

Many nations now treat remote workers as a targeted market. They design permits to stimulate tourism revenue, fill seasonal gaps, and boost local spending.

- Europe leads with strong infrastructure and lifestyle perks, though costs can be higher.

- Spain, Portugal, and the Netherlands stand out for tax rules and flexible paths.

- Over 50–66 programs exist, and governments optimize processing, tax breaks, or community services to compete.

For background on how workforce trends drive these policy moves, see how countries attract remote workers.

What a digital nomad visa is—and how it differs from tourist visas

Think of a nomad permit as a legal bridge: you stay in another country while you continue working for employers or clients back home.

A digital nomad visa is a temporary permit that lets you legally live and work remotely from a host country without taking a local job. Most programs run six to 12 months and often let you extend or reapply later.

Tourist visas are shorter and usually forbid work. Overstaying tourist days can lead to fines, entry bans, or trouble with future applications.

Longer stays, legal remote work, and potential tax perks

Typical requirements include proof of employment or self-employment outside the host country, minimum income, health insurance, a clean background check, and a valid passport.

- Stay length: Often 6–12 months with renewal paths.

- Work rules: You may work remotely for foreign clients but not local employers.

- Tax notes: Some countries offer tax relief—examples range from exemptions to partial reductions for qualifying periods.

Families can sometimes join under a single application, but rules vary by country. Follow the application steps closely to avoid surprises and to protect your legal status while you live and work abroad.

Core eligibility requirements you’ll likely need to meet

Start with the paperwork: countries share a core set of rules you must meet to qualify for a remote-work permit.

Proof of remote work, monthly income, and insurance

Proof of work: show employment contracts, recent client invoices, or company registration that proves your income comes from outside the host country.

Income requirement: thresholds vary — Spain ≈€2,760/month, Portugal D8 ≈€3,480/month, Greece €3,500+, Italy ≈€24,789/year, Croatia ≈€3,295/month (2025). Showing steady earnings for 3–6 months strengthens your case.

Health insurance: most countries require coverage with set limits (Costa Rica example: $50,000). Buy a policy that matches host-country rules before you file.

Criminal record, passport, and accommodation

- Clean criminal record: source, apostille, and translate documents if needed.

- Valid passport: often 6–12 months beyond your stay and with spare pages.

- Accommodation evidence: leases, hotel bookings, or host letters are usually acceptable.

“Label your application clearly and include recent bank statements, tax IDs, and any education or experience proof to avoid delays.”

How to pick the right country: what to look for

Picking the right country starts with matching your daily needs to local rules. Focus on internet reliability, cost, healthcare, and how long you can stay under a visa or residence permit.

Internet, safety, and cost of living

Check connection quality first. Read accommodation reviews, test local coworking spaces, and confirm average speeds. Portugal and Spain often rank high among EU peers.

Compare cost living across shortlist cities. Add rent, transport, groceries, and coworking to see if your income covers basics and extras.

Tax residency, visa length, and renewals

Learn the tax residency rules—many countries use a 183-day guideline. Some programs grant temporary tax relief to remote workers or nomads.

Compare visa length and renewals. Some offer six months, others 12 months or pathways to a multi-year residence permit.

Community, language, transport, and climate fit

Weigh community options: coworking density, meetups, and expat groups help you settle fast.

Also factor in language, transport links, and climate. Schengen Area access can make intra‑Europe travel easier if that matters to you.

- Assess speeds by checking local reviews and coworking reports.

- Match income expectations to monthly cost and visa requirements.

- Prioritize a country where your work remotely setup and lifestyle align with visa terms.

Digital Nomad Visas

Today you can compare dozens of programs that let you live abroad while keeping your home‑based work and income streams intact.

What most programs share: stays generally run 6–12 months with renewal options. You must show steady income, evidence of remote work, and qualifying health insurance.

Regions with the densest offers include Europe, Latin America, and parts of Asia and the Middle East. Some countries call their permit a nomad residence or special permit rather than a regular visa.

- Initial durations: many start at one year; a few extend to 18 months or offer multi‑year renewals.

- Documentation overlap: contracts, recent bank statements, and insurance often cover multiple filings.

- Cost and processing: online filings tend to be faster; consulate routes can add time and fees.

“Plan for tax consequences early — benefits and obligations vary by country.”

With this quick hub, you’ll be ready to drill into country picks like Estonia, UAE, or Costa Rica and tailor your application and budget to local requirements.

Top European contenders competing for remote workers

If you want a European base, five countries stand out for their tax breaks and permit lengths.

Spain

Spain requires about a ~€2,760 monthly income and offers a 20% tax cap for qualifying applicants.

You can apply from home or in-country. The route starts with a visa and can lead to a residence permit of up to three years. Families may join under the same application.

Portugal

Portugal splits options: D8 targets active income (~€3,480/month) while D7 fits lower passive income.

Both give Schengen mobility and a clear five‑year path to permanent residency and citizenship.

Italy, Croatia, Greece

Italy launched a 2024 route with ~€24,789 annual income and a one‑year renewable permit that allows family inclusion.

Croatia issues a 6–12 month residence permit and stands out with no local income tax for remote workers.

Greece is relatively easy to access at ≈€3,500+/month and may offer up to 50% tax relief for several years.

“Compare processing methods — online or consulate — and gather clear proof of income and prior work to meet each country’s requirements.”

More European programs worth your radar

Several European programs now offer distinct permit types and fast tracks that suit different work styles and family plans.

Estonia — C and D options, tech-friendly

Estonia led early efforts with a digital-first approach. Short-stay C permits run about three months. Long-stay D permits extend up to 12 months.

The government targets an income near €3,504 gross per month and emphasizes online filings.

Germany — Freelancer route for creatives and pros

The Freelancer (Freiberufler) option suits liberal professions. You can secure a permit up to three years.

It requires client contracts or steady freelance income and can enable EU mobility and family reunification.

Romania, Hungary, and Malta — speed, singles, and English comfort

- Romania: fast approvals (often 10–14 days), an income guideline near €3,900/month, and one‑ to two‑year permits with family inclusion.

- Hungary: the White Card targets singles with a ~€2,000+/month threshold and one‑year renewable terms.

- Malta: the Nomad Residence Permit asks for about €2,850/month, renews yearly, and is English‑friendly with favorable tax rules if your income is taxed abroad.

“Check whether a program wants client contracts, employer letters, or bank savings to meet application requirements.”

Flexible or alternative pathways in Europe

If a named remote program doesn’t fit your profile, several European routes still let you live and work abroad legally. These options range from business‑plan permits to short stays with specific income rules. Pick a path that matches your work, risk tolerance, and timeline.

Netherlands — self‑employed permit

How it works: apply with a business plan. Fees run near €407 and approval depends on the viability of your proposal and projected income.

France — Long Stay Visa

One‑year renewable option that grants Schengen mobility. Typical minimum income guidance is low (~€615/month), but you must show steady means.

Switzerland, Iceland, Norway

- Switzerland: cantonal self‑employment permits; fees and rules vary—expect high cost of living.

- Iceland: six months, high threshold (~€6,866/month) and a mail‑in application process.

- Norway (Svalbard): unusual two‑year independent contractor route with fast processing (~15 days).

Georgia, Bulgaria, Montenegro

Georgia: “Remotely From Georgia” — no fee, about €2,000/month, one year and simple online steps.

Bulgaria: new 2025 freelance program with a flat 10% tax and modest consular fees.

Montenegro: a two‑year intent announced; details remain TBA.

“Compare speed, cost, and documentation — business plans, client contracts, or bank proof often decide the outcome.”

Beyond Europe: standout digital nomad destinations

Outside Europe you’ll find destinations that range from short, high‑bar programs to decade‑long residence options.

Japan

Length: six months. Income: high threshold — about ¥10 million/year (~€58,420).

The program has limited renewal paths, so plan a return or alternate permit if you want longer stays.

Dubai (UAE)

Length: one year. Perks: no income tax and excellent global connectivity.

Expect a fee near $611 covering processing, medical checks, and an ID. Monthly income guidance is roughly $3,500.

Panama

Panama offers a quick nine‑month route geared to foreign employment. It’s tax‑friendly and often fast to process.

Costa Rica

Length: one year, extendable. Income: about $3,000/month or $4,000 with dependents.

You’ll need robust insurance (~$50,000) but enjoy local tax exemptions for qualifying workers.

Thailand LTR

The Work‑From‑Thailand track can reach up to 10 years for qualified professionals. It has strict banking and financial criteria.

Malaysia — DE Rantau

DE Rantau runs 12 months and renews once. Minimum income is around $24,000/year and fees include MYR1,000 plus MYR500 per dependent.

South Korea

Permits can last up to two years. Expect a higher income threshold (~₩84,960,000/year), plus insurance and experience requirements.

Philippines

Offers a 12‑month route with renewal possible and local tax exemption on foreign income. Good for longer seasonal stays.

“Match permit length, tax rules, and connectivity to your client market before you apply.”

- Compare: Japan’s high annual income vs. Dubai’s one‑year, tax‑free hub.

- Consider: family rules, insurance, and processing — embassy or online.

- Shortlist: based on tax, lifestyle, and how many months you plan to stay.

Income requirements snapshot: what “sufficient income” looks like

Before you apply, compare monthly and annual thresholds so your bank statements match the host country’s rules.

Typical thresholds: monthly vs. annual targets

Hosts use either a monthly income floor or an annual total to judge your capacity to live and work abroad.

- Common monthly ranges: €2,000–€3,900 in many European programs (Spain ≈€2,760; Portugal D8 €3,480; Greece ≈€3,500+; Croatia ≈€3,295).

- Annual examples: Italy ≈€24,789/year; Japan ≈€58,420/year; Malaysia ≈$24,000/year; South Korea ≈₩84,960,000/year.

- Other regions: Dubai ≈$3,500/month; Costa Rica ≈$3,000/month solo ($4,000 with dependents); Romania ≈€3,900/month; Hungary €2,000+; Malta €2,850/month.

How dependents change the requirement

Many countries add a buffer for family. Expect roughly +20% for a spouse and +15% per child, or higher flat fees in some programs.

Tip: show steady client invoices, consistent deposits, and an employer letter or notarized affidavit to strengthen proof of income requirement.

“Aim 10–20% above the posted minimum and match your statements to the host currency to reduce application scrutiny.”

Visa lengths, renewals, and pathways to longer stays

Look at duration first — from six‑month programs to pathways that lead to multi‑year stays and residency. Your choice affects travel freedom, tax days, and long‑term plans.

Six months to multi‑year options

Short stays: Japan’s route offers six months with no routine extension, so plan exit or a new application early.

One‑year baselines: Malta and many island or tropical programs start at 12 months and allow yearly renewal if you meet requirements.

Extended tracks: Croatia now allows up to 18 months (2025 update). Spain can start with one year then convert toward a residence permit for up to three years.

Schengen access and the road to residency or citizenship

If Schengen mobility matters, pick routes that grant it. Portugal’s D8/D7 paths can lead to permanent residency and citizenship after five years.

Germany’s freelancer permit renews and commonly supports multi‑year stays. Keep a clean application file: insurance, income, and housing docs to speed renewals.

“Track residence days to avoid unintended tax residency and prepare renewal paperwork well before expiry.”

- Compare short stays (Japan) with long arcs (Spain, Portugal).

- Note renewals that are straightforward (Malta, Germany) versus those requiring a gap or fresh application.

- Design a sequence of stays to cover travel needs while avoiding tax triggers.

Taxes for digital nomads: where you might pay—and where you might not

Tax rules can change whether your year abroad feels like a saving or a surprise expense. Understand how a host country treats your pay before you arrive.

Countries with tax exemptions or reductions

Croatia and Costa Rica offer clear exemptions for qualifying remote workers. Dubai (UAE) has no personal income tax, making it attractive if the cost and visa requirements fit your plan.

Greece may cut taxable income by about 50% for several years. Thailand taxes foreign income only if you are a resident and you remit funds in the same year.

Understanding tax residency and the 183‑day rule

Days on the ground matter. Many countries use a 183‑day guideline to trigger tax residency. That shift can change where your income is taxed and for how many years.

“Map where your employer is, where services are performed, and where taxes will fall to avoid double taxation.”

- Use treaties and foreign tax credits to reduce double tax risk.

- Track days, local leases, and family presence—these can nudge residency.

- Consult a tax pro if your income is multi‑sourced or complex.

Application process, documents, and timelines

Start your application by deciding whether an online portal or a consulate interview fits your timeline and comfort level. Many countries let you complete the whole application process online. Others require you to file at a consulate and attend an interview.

Online vs. consulate filings and interviews

Online filings often move faster and let you upload PDFs of your passport, proof of remote work, bank statements, and insurance. Consulate filings can require an in‑person interview and original documents.

Common processing times and how to avoid delays

Typical timelines vary from about 10–15 days in fast programs (Romania 10–14 days; Svalbard ~15 days) to several weeks or months elsewhere. Fees and local holidays also affect days to approval.

- Assemble a universal pack: valid passport, employer or client proof, 3–6 months of income statements, health insurance, lease or booking, and a clean background check.

- Prepare translations, apostilles, and notarizations in advance to avoid last‑minute scrambling.

- Book consular appointments early and track embassy calendars to avoid holiday closures.

“Front‑load accuracy: match names, dates, and currencies across every document to reduce resubmissions.”

For dependents, add marriage and birth certificates, extra insurance, and the higher income proof the country may require. Keep both paper and secure digital copies of every application package for renewals and future applications.

Visa costs and hidden fees to budget for

Budgeting for a permit means more than the headline fee. Start with consular charges and add residence permit or ID costs so you know the real cost for your first year.

Examples: Spain shows about $73 consular plus ~$80 for an NIE. Portugal runs roughly $75 for entry and $90 for residence. Other samples: Italy ~$116; Croatia ~$73 + $66; Germany ~$105; Malta ~$316; Netherlands ~$407; Dubai ~$611 (covers medical and Emirates ID); Malaysia MYR1,000 + MYR500 per dependent.

Also factor in translations, apostilles, and notarizations. These can add hundreds of dollars. Health insurance is often mandatory and rises with family size.

- Plan for courier and postal fees for mail‑in applications (Iceland and others).

- Include initial housing costs: deposits and agency fees affect your cost living estimate.

- Account for travel to consulates, biometric appointments, and possible interview trips.

“Set aside a cushion equal to 1–2 months of expenses to handle delays without stress.”

Don’t forget renewals, coworking, SIMs, equipment, and tax prep. Those recurring costs shape the real annual cost and help you meet income and application requirements without surprises.

How countries are competing: incentives beyond the visa stamp

Governments now compete on perks that go far beyond a simple stamp in your passport. You’ll find tax caps, family-friendly terms, and faster processing used as clear selling points. These moves affect cost, speed, and daily life once you arrive.

Tax, family rules, and fast tracks

Tax breaks are a major draw — for example, Spain’s 20% cap and Dubai’s zero income tax. Some countries offer a simpler, transparent set of requirements to speed approval. Romania is known for quick turnaround, while Georgia still charges no entry fee for many applicants.

Infrastructure, language, and communities

English friendliness and strong internet make onboarding easier. Malta highlights its English environment. Cities such as Lisbon, Barcelona, Tallinn, Split, and Budapest build dense coworking scenes and meetups that help you join a local network fast.

- You’ll see how countries offer tax relief and clear requirements.

- Compare family inclusion and processing speed when you plan moves.

- Weigh infrastructure, safety, and coworking density as part of your decision.

“Pick a destination where the on‑ramps match your priorities — tax planning, family needs, or community support.”

How to choose your first (or next) base as a U.S. remote worker

Pick a base that fits your meeting hours, travel needs, and healthcare expectations so your work stays smooth. Start with practical checks and you’ll avoid surprises when you arrive.

Aligning time zones, flights, and healthcare access

Time matters. Map client call windows to local time — East Coast overlap often favors Portugal and Spain for morning meetings. If you need late U.S. calls, consider hubs like Dubai that pair good connectivity with nonstop flights.

Verify healthcare: check private hospital quality and English-speaking clinics. Good coverage and clear insurance requirements speed your visa application and protect your family.

Balancing cost of living with lifestyle and network

Run a cost living check against your income. Confirm rent, coworking fees, and daily expenses fit the income test for the visa you plan to apply for.

- Weight tax stance—Costa Rica, Croatia, and the UAE offer simpler tax options for some workers.

- Scout community: meetups, coworking density, and U.S. expat groups speed onboarding.

- Prepare a second-choice country and a mobility kit (bank letters, notarized docs) to pivot fast if an application stalls.

“Match time zones and travel access first, then layer in healthcare, cost, and tax planning.”

Conclusion

Conclusion

Armed with income thresholds, timelines, and tax notes, you can plan a smooth move and avoid common application pitfalls.

You’re ready to compare programs by income, duration, tax treatment, and renewal paths. Pick a country that fits your meeting hours, budget, and family needs. Keep clear proof of work, health insurance, and translated documents to speed any application.

Budget for fees, translations, and setup costs so surprises don’t derail your first year. Track days on the ground to manage tax residency and get professional help for complex cases.

Use communities, coworking, and English‑friendly services to settle fast. For background on workforce trends that shape these options, read how countries attract remote workers.