Last Updated on February 11, 2026

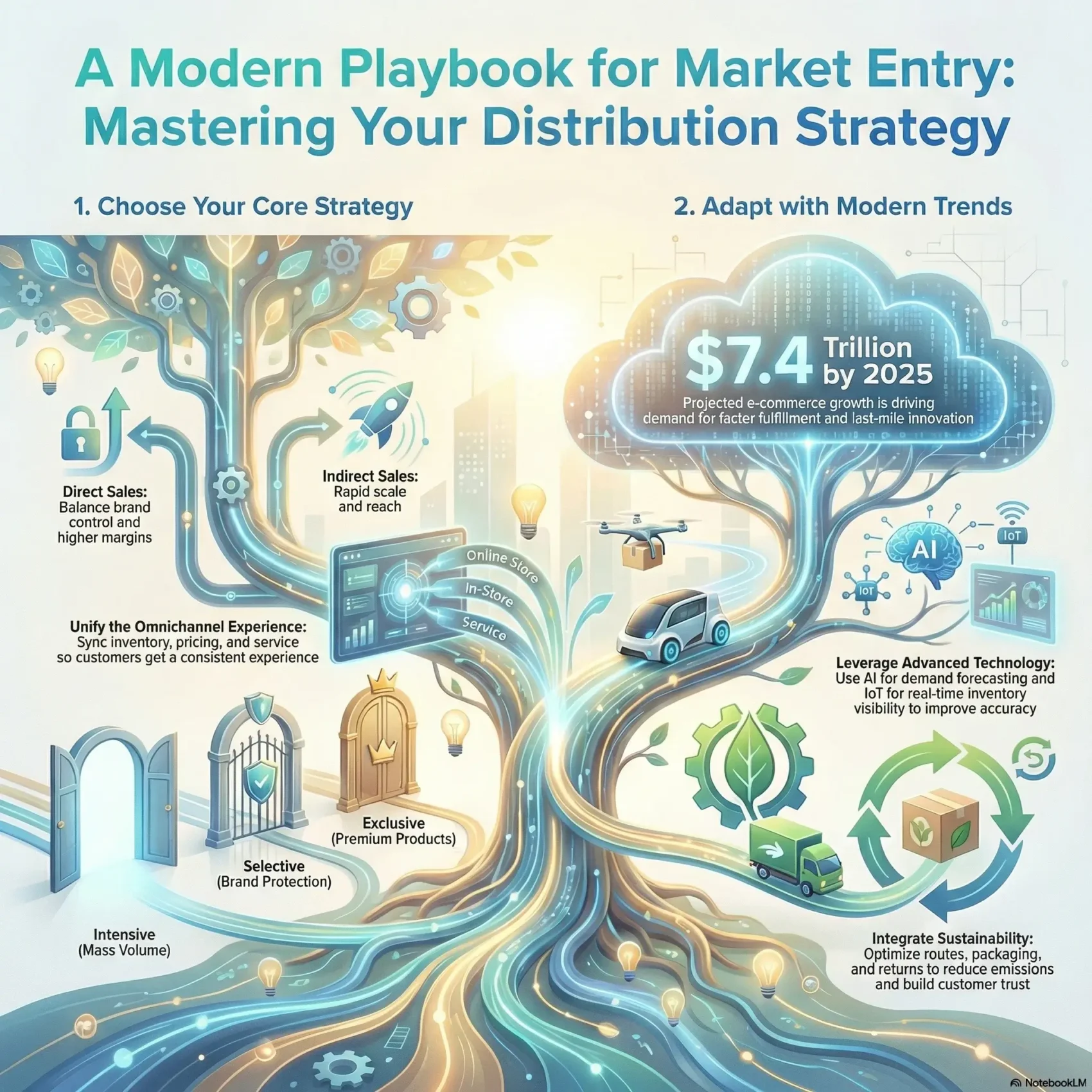

You need a clear plan to move products, win customers, and grow in the United States. Ninety-one percent of companies call their distribution approach a key factor in performance, and e-commerce sales are set to hit $7.4 trillion by 2026.

This introduction shows why a flexible model matters and how it links your routes-to-market with measurable growth. You’ll see how to size demand, pick channels, and align execution so your company scales without losing brand control.

We’ll also highlight tools, partner motions, and risks to watch when entering fast-moving markets. If you want practical steps, start by reading about omnichannel choices and how they shape outcomes at your omnichannel playbook.

Key Takeaways

- Clear definitions help you connect route choices to measurable growth.

- Use a flexible model to respond to competitors and customer shifts quickly.

- Link planning and execution to scale while keeping brand consistency.

- Rely on data to size demand and prioritize high-value investments.

- Watch for execution risks when entering new markets and mitigate them early.

Set the foundation: what a distribution strategy is and why it guides your market play

Clarify how your products travel through the chain so you can pick channels that amplify your brand. In plain terms, a distribution strategy defines how goods move from production to the end customer. It covers inventory, storage, processing, transportation, tracking, and the point of sale.

Physical and digital endpoints matter for different goals. Physical outlets and e-commerce have different needs for packaging, assortment, and content. You choose where your product lives based on audience, category norms, and your growth targets.

Think of primary and secondary channels as roles in the customer journey. Primary channels drive volume and visibility. Secondary channels support niche segments or geography and protect margins.

- Use category benchmarks to avoid poor placements that harm margins.

- Quantify readiness with inventory visibility, order management, and data sync.

- Document core principles so partners and teams act consistently.

Why your distribution strategy drives performance, efficiency, and customer experience

Efficient routes and pooled warehouses turn complex logistics into a competitive advantage. When you tighten your network, you shorten lead times, cut waste, and free budget for growth. Shared fulfillment centers and accurate inventory tracking give you the visibility to move faster and reduce errors.

Cutting costs and time-to-market through streamlined channels and shared infrastructure

Route optimization, pooled facilities, and real-time stock data speed launches and lower unit cost. You’ll remove hidden costs like extra handling, emergency freight, and mis-picks without harming service levels.

- Use route and warehouse pooling to shrink transit days and reduce costs.

- Set SLAs with partners to protect on-time delivery and handling quality.

- Track speed, accuracy, fill rate, and NPS to tie operations to revenue.

Designing for customer experience across online and offline touchpoints

Omnichannel approaches let you offer fast fulfillment, buy-online-pickup-in-store, and transparent tracking that boost loyalty. Thoughtful channel design shapes product discovery, purchase, delivery, and returns so every touch feels consistent.

What’s changing now: trends reshaping how you reach customers in the United States

New buying habits and tech are changing the way you get products into customers’ hands. E-commerce is on track to hit $7.4 trillion globally by 2026, and that growth forces updates in how firms operate in the U.S. market.

Omnichannel and e-commerce acceleration across retail and B2B

Leaders blend online and physical stores to give a single buying journey. You’ll see more ship-from-store, curbside pickup, and B2B marketplaces that act like retail. These moves let you meet customers where they prefer to buy.

Faster fulfillment, micro-fulfillment, and last-mile innovation

Consumers expect rapid delivery. Micro-fulfillment and urban sortation centers support same-day windows. Last-mile partners and local hubs cut transit time and lift the customer experience.

Sustainability as a growth and compliance mandate

Eco-packaging, emissions reduction, and supplier rules are now business priorities. Deliveroo’s carbon neutrality efforts show how sustainability can become both a compliance task and a growth signal for customers.

Advanced supply chain tech: AI, IoT, robotics, and blockchain

AI improves demand sensing. IoT increases visibility. Robotics speed picking in warehouses. Blockchain helps traceability across the chain. Together, these tools give you better data and lower errors.

“Fast delivery, clear traceability, and greener choices are no longer optional — they shape who wins and who falls behind.”

- Snapshot of forces: omnichannel retail to B2B marketplaces.

- Fulfillment trends: micro-centers and last-mile innovation.

- Sustainability example: carbon targets influencing routing and packaging.

- Tech impact: better data, faster fulfillment, and improved experience.

Distribution strategy model: core approaches you can combine for reach and control

Your channel mix decides how customers discover, buy, and return your product. You’ll weigh direct routes that protect your brand and margins against indirect paths that deliver scale through wholesalers, VARs, and retailers.

Direct vs. indirect

Direct sales let you control pricing, packaging, and service, but they demand fulfillment and storefront capabilities. Indirect partners extend reach quickly and add local expertise, though you trade some control.

Selective, intensive, exclusive placements

Pick selective retailing for mid-market appeal. Use intensive placement to chase volume and visibility. Reserve exclusive deals for premium products that rely on scarcity to justify higher prices.

Dual and hybrid setups

Combine your storefronts with wholesale networks to balance margin and coverage. Govern partner rules to avoid cannibalization and keep retailer trust intact.

Omnichannel orchestration

Align inventory, pricing, and service so customers get the same experience online or in-store. Shared SKUs and synced content reduce confusion and protect brand equity.

Reverse routes for value recovery

Plan returns, repair, and recycling to reclaim value and build customer trust. Programs like Patagonia’s repair focus show how circular flows boost loyalty and sustainability.

- Brief retailers and intermediaries clearly on presentation and service standards.

- Phase channels as you scale: start focused, then layer partners.

- Set governance to prevent conflicts and preserve brand control.

Pricing meets distribution: how your price architecture shapes channels—and vice versa

Price design often decides which retailers take your product and how customers perceive its value. Aligning price with placement ensures premium cues match selective outlets, while value pricing fits mass e-commerce and big-box retail.

Aligning market perception and placement with premium or value pricing

Match signal to shelf. Use MSRP and controlled placements to protect premium positioning. For value offers, optimize pack sizes and promotions for high-volume channels so your product reads as affordable and accessible.

Managing costs, margins, and retailer expectations across channels

Account for fees, commissions, and logistics when you set list prices. Build margin guardrails and MAP rules to guide retailer negotiations and prevent margin erosion.

Dynamic, tiered, and volume approaches that support partner sell-through

Use tiered discounts, volume ladders, and time-bound promos to power sell-through without igniting price wars. Pair data signals with rules to update prices by channel while keeping core equity intact.

- Set price floors and promo windows to protect brand value.

- Model net margin after cost and channel fees before launch.

- Measure sales impact by channel and iterate quickly.

Choosing the right distribution channels for new markets

When entering a new market, the best wins come from aligning who you sell to with where they expect to shop. Map customer journeys by segment, use case, and geography to see where buyers discover, compare, and purchase.

Map your customer journeys by segment, use case, and geography

Sketch short paths for each target. Note browsing habits, device preferences, and local purchase triggers. This shows which channels will drive discovery and sales.

Audit capabilities, costs, and desired control across potential channels

Score options by fulfillment ability, cost to serve, and the level of control you need over pricing and brand. Dual approaches can protect margins while extending reach.

Resolve channel conflict with segmentation, territories, and clear rules

Assign target segments to each channel, set territories and assortments, and publish transparent rules to reduce overlap and friction among partners.

Pilot, measure, and scale with localized partners and playbooks

Run small pilots to validate pricing, service, and demand. Pick partners by coverage and competence, build playbooks for onboarding, and use KPIs to decide when to expand.

For practical omnichannel guidance, review our omnichannel playbook to align pricing, promo calendars, and partner enablement across channels.

Technology and data to power your channel strategy

Good tech ties your front-end commerce to the warehouse so customers always see what’s actually available. That single link reduces out-of-stocks, speeds delivery, and protects your brand across every touchpoint.

Unified inventory, order, and content data across endpoints

Make one source of truth for inventory, orders, and product content. Master data and taxonomy keep specs and images consistent so listings convert and returns fall.

RFID and item-level tracking (think Guess) plus IoT sensors give real-time location and stock counts. That visibility improves operations and ups fulfillment accuracy.

Forecasting, route optimization, and demand sensing with AI/ML

AI predicts demand spikes so you align production and capacity ahead of time. Machine learning also optimizes routes and ETAs to cut transit time and costs.

Use alerts and KPIs — fill rate, ETA variance, and forecast error — so your teams act before customers feel a problem.

Enabling partners with integrations, training, and shared analytics

Partner portals and shared dashboards speed onboarding and lift execution quality. Offer APIs, content syndication, and playbooks so partners sell your product the right way.

- Invest in clean data governance and syndication rules.

- Decide build vs. buy for tools that scale without huge headcount.

- Run joint reviews with partners to keep targets aligned.

“Unified systems turn good intentions into reliable customer experiences.”

Building sustainability into your distribution for long-term value

You can cut emissions and add market value by making sustainability part of how you move and care for product. Small changes in transport, packaging, and facilities reduce costs and strengthen your brand promise.

Lowering emissions with optimized modes, routes, and packaging

Shift to lower-emission transport and tighten routes to reduce fuel use and transit time. Right-sized packaging and recycled materials lower waste and handling costs.

Designing logistics for returns, repair, and recycling

Plan for returns and in-market repair so products live longer and waste falls. Patagonia’s repair-at-scale is an example that builds trust while protecting margin.

- Roadmap: set targets that cut emissions without hurting service.

- Operations upgrades: solar at facilities and energy-efficient systems improve resilience.

- Partner rules: train vendors to meet packaging and handling standards.

- Measure: report credible KPIs across the chain and with partners.

Prioritize initiatives by impact and feasibility so sustainability enhances experience, not friction. With clear goals, you deliver environmental value and better support for customers and products.

Hospitality and retail insights: adapting distribution for experiential products

When your offering is an experience, you must balance visibility on OTAs with direct channels that deepen guest loyalty. That mix shapes profit per stay and how your brand reads across touchpoints.

Balancing direct bookings, OTAs, GDS, and metasearch for profitability

OTAs, GDSs (Sabre, Amadeus, Travelport) and metasearch sites pull broad demand but take commissions that cut net revenue.

You want to steer customers to direct bookings using loyalty perks, exclusive add-ons, and simple booking flows that increase margin.

Elevating guest experience with omnichannel loyalty and service

Borrow retail playbooks from Starbucks and Sephora to sync offers across online and stores. Consistent content, pricing rules, and fulfillment make stays feel seamless.

Partnering for eco-conscious travel and localized access

Work with rideshare, local tours, and EV charging providers to add value and signal sustainability. Scorecards keep partners accountable on quality, upsell, and access.

“Design rules for cancellation, recovery, and post-stay touchpoints so marketing, sales, and operations deliver the promise.”

- Map which channels bring which guests and set availability rules to protect rate parity.

- Use loyalty to convert lookers to bookers and measure margin by channel.

- Align partner KPIs to guard brand standards and guest satisfaction.

Execution roadmap: activate, govern, and optimize your distribution network

Begin by turning plans into contracts, integrations, and shared visibility so partners can sell confidently from day one.

Activation includes finalizing partner terms, wiring APIs for marketplaces, and proving unified inventory so you avoid oversells. Get commercial terms signed and run test orders before go-live.

Contracting, onboarding, and enabling channel partners

Onboard with a pack of ready assets: product content, pricing rules, and comms templates. Train reps, share playbooks, and set clear SLAs for lead time, returns, and service.

Operational readiness: SLAs, assortment, pricing, and inventory sync

Define assortment by channel and lock pricing bands to prevent conflicts. Sync inventory to a single source of truth and publish SLA targets so operations meet expectations.

Performance management: velocity, mix, and customer metrics by channel

Track sales velocity, product mix, margin, and NPS per channel. Use partner scorecards with incentives and remediation paths to drive continuous improvement.

- Set governance cadence: weekly reviews, quarterly committees, and living documentation.

- Run pilots and A/B tests to learn quickly without risking core sales.

- Map escalation paths so operational issues are fixed fast and on-brand.

Conclusion

Conclude with a compact action plan that helps you test channels, measure impact, and scale fast. ,

Start small and deliberate: assess where your product fits, pilot the top channels, and track simple KPIs for reach, margin, and sales.

Use what works and pause what doesn’t. Align pricing and placement to your brand so customers find consistent value across the market. Build governance that keeps partners accountable and teams aligned.

Remember trends—e-commerce growth, sustainability, and new tech—will change your playbook. Apply this model as a living guide: assess, instrument, iterate, and measure growth at every step.