Last Updated on January 3, 2026

You need more than a number on a tag to grow predictably. A clear pricing plan is your blueprint: it shapes brand perception, guides setting prices, and protects profit as markets shift.

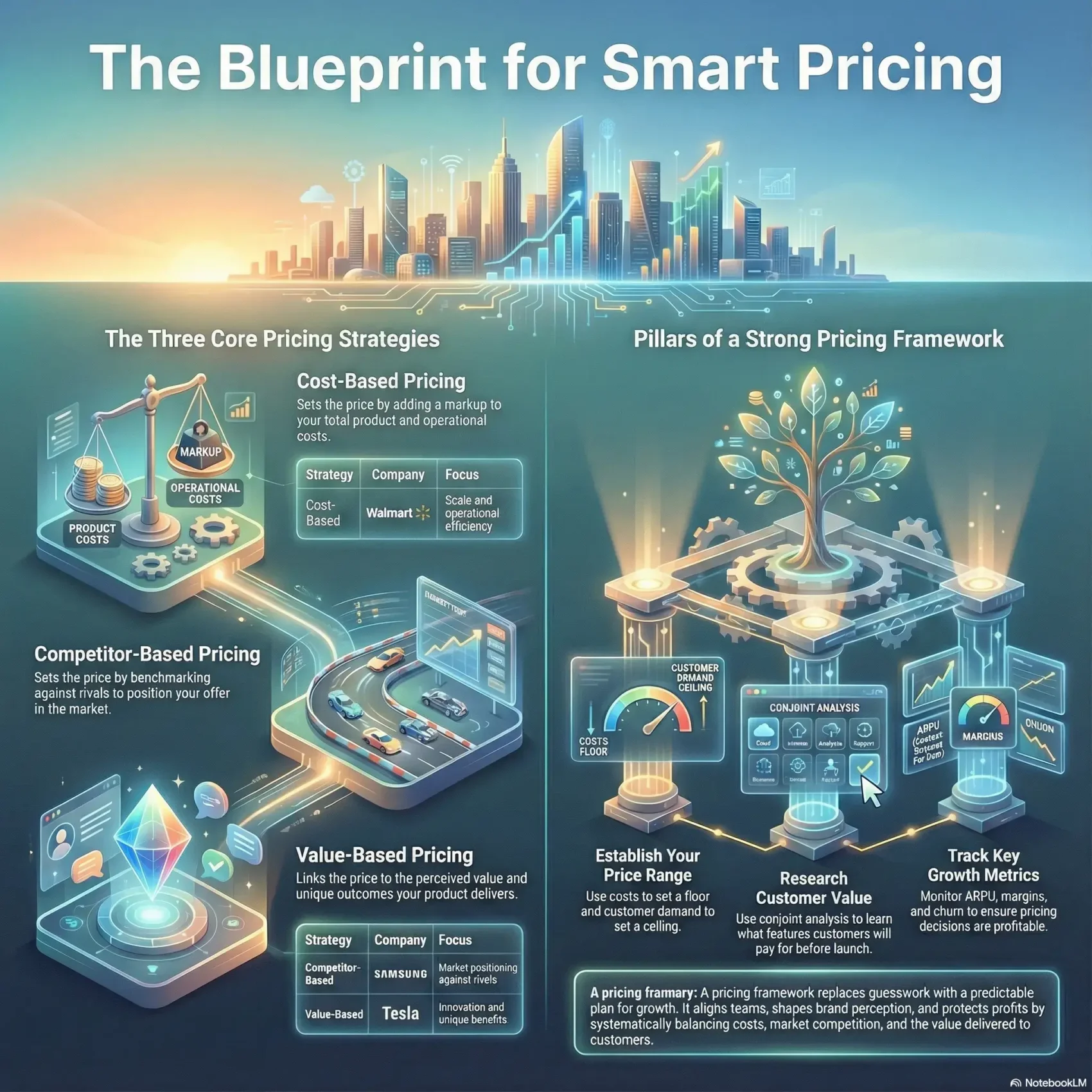

Think of three core approaches: cost-based, competitor-based, and value-based. Big names show how each works — Walmart on cost, Samsung on competition, and Tesla on value — and each choice affects customer trust and sales.

Underpinning any plan are costs, margin types, and markup. Too-low price points can erode brand value, while the right pricing can lift perceived value and profit. Use research tools like conjoint analysis to quantify willingness to pay before launch.

Key Takeaways

- Learn what a pricing plan is and why it drives predictable growth.

- See how price decisions shape brand, sales, and profit across the U.S. market.

- Compare cost-, competitor-, and value-based models with real company examples.

- Use research and metrics to measure value and test setting prices.

- Align pricing with customer outcomes and your company stage for smarter decisions.

Why Your Pricing Deserves a Framework, Not a Guess

Too many companies pick a number by gut; a clear plan turns guesswork into predictable results. You need a short, documented approach so teams make consistent choices and avoid random cuts that eat margin.

Matching search intent: you want clear steps that link price to acquisition, retention, and expansion in the US market. A documented pricing strategy gives those steps and measurable checkpoints.

How a documented approach helps your business

Aligns teams — marketing, sales, product, and support all use the same rules to set and defend price points. This reduces surprise discounts and preserves profit.

What “ultimate guide” means for you today

It means practical tools: competitive benchmarks that anchor customer expectations, research methods to test willingness to pay, and templates you can use under U.S. regulations. Benchmarks inform fair price ranges but should reflect features, service levels, or a no-frills offering.

- Stop relying on static lists and blanket discounts.

- Use data to adjust prices quickly when competition or demand shifts.

- See pricing as a cross-functional way to influence product and growth.

Pricing Fundamentals You Need Before Setting Prices

Start by securing a true cost floor so your business never sells below what it takes to deliver. You’ll map costs first, then layer in value and market signals.

COGS, operating costs, and cost to serve: setting your price floor

COGS includes materials, manufacturing, production labor, supplier payments, and typical losses. It does not include rent or marketing, which are operating costs.

To set a sustainable floor, add COGS, operating costs, and the cost to serve each customer. This prevents accidental loss-making prices.

Gross margin vs. markup: how margins protect profit and allow adjustments

Markup gets you from cost to selling price. Gross margin is what remains after direct costs. Protecting margin gives room for promotions and safe tests.

“A clear margin lets you run offers without risking the business.”

- Compare operating, EBITDA, and net margins to see which levers you can pull.

- Use margin targets to define guardrails before competitive analysis.

Price perception and demand: connecting willingness to pay with value

Higher or lower prices change perceived quality and demand. Some customers equate higher prices with better features; others see low prices as a red flag.

Identify which features your customer values and what trade-offs they accept. Establish floors and initial guardrails, then test in the market.

For related commercial operating trends and how revenue operations affect price decisions, read RevOps trends.

Why Getting the Price Right Changes Brand Perception and Profitability

How you set a price sends a clear signal about who your product is for and what it promises. The right approach helps you attract the customers you want and protects margin as the market shifts.

Perceived value: why higher prices can increase desirability

Higher prices often raise expectations. For status or aspirational products, a premium tag can make your offer feel more exclusive and trustworthy.

This works best when you pair price with proof: superior features, service, or sustainability that show why your value product costs more.

When low prices erode trust and margins

Discounting might boost short-term sales, but low prices can suggest poor quality. That perception can repel repeat buyers and squeeze profit.

Keep floors that cover costs and service so you avoid a race to the bottom.

Anchoring against competitors to signal fair value

Use competitor benchmarks to set a psychological anchor in the market. If you price above competitors, explain the difference with clear benefits.

- Signal quality: show what’s included, not just what it costs.

- Frame choice: offer a no-frills option and a premium tier for clarity.

- Protect margin: justify any higher price with tangible customer outcomes.

“Customers pay for certainty as much as for features.”

Pricing strategy framework: The Pillars You’ll Build On

Create clear pillars so your price decisions reflect brand position, customer value, and competitive reality. This keeps you from chasing one metric while losing ground on others.

Align with business goals, customer needs, and competition

Start by mapping how price supports growth, margin, and brand promise. Tie each tier to a clear customer outcome so buyers understand what they get.

Balance revenue, profit, and retention for sustainable growth

Don’t pick short wins over long-term health. You must weigh acquisition lifts against churn and margin erosion. Aim for gains that compound, not spikes that fade.

Operationalize with data, experiments, and ongoing adjustments

- Define pillars that match your business model, segments, and competitors.

- Set a cadence for tests and reviews so your numbers stay current with the market.

- Make decisions on holds, raises, or cuts using customer signals and margin guardrails.

- Embed governance — who approves changes, how you announce them, and which metrics prove success.

“Data-based tweaks and periodic reviews beat guesswork every time.”

Know Your Customer’s Willingness to Pay with Pricing Research

You can learn what customers will actually buy by testing combinations of features and price points. That insight saves time and reduces launch risk when you pick a product and price in the U.S. market.

Conjoint analysis vs. legacy methods

Conjoint analysis (Discrete Choice Modeling) measures trade-offs and price sensitivity more accurately than Van Westendorp or Gabor‑Grainger. Those legacy tools estimate ranges, but conjoint shows which feature mix customers prefer at specific prices.

Simulating features, prices, and competitors

Run simulators to model bundles, tiers, and competitor moves before launch. You can predict share, profit, and how small feature changes move willingness to pay.

Turn insights into product packaging and decisions

Use results to craft tiers that match real buyer choices, not internal assumptions. Validate that a proposed price sits inside acceptable ranges for each segment.

- Validate bundles: keep what customers value, drop the rest.

- Benchmark offers: compare against competitors to justify price gaps.

- Feed roadmaps: prioritize features that raise willingness to pay.

“Accurate research converts customer signals into actionable price and product decisions.”

The Core Pricing Strategies and When to Use Them

Choose the right approach to set price so your offer fits the market and your margin goals.

Cost-based: simple floors and Walmart-style execution

Cost-based marks up your cost to set price. Use it when margins are thin and scale matters.

Walmart uses this to negotiate lower supplier costs and keep everyday low prices.

Competitor-based: benchmark and respond

Set price by watching rivals in crowded categories. Samsung tracks Apple and others to stay competitive.

This method helps you position products quickly when competition is tight.

Value-based: charge for perceived value like Tesla

Value-based pricing links price to perceived value. Tesla commands premiums by selling innovation and sustainability.

Use this when your differentiation is clear and customers pay for outcomes.

- Use cost for floors and operational scale.

- Use competitor signals for market context and positioning.

- Use value-based pricing to capture maximum profit when your offer is unique.

Tactical Pricing Plays That Move Markets

Small, deliberate pricing plays often decide whether products win or fade in a crowded market. Use these short-term moves to shape demand, test value, and set expectations for your customers.

Penetration pricing: jump-start demand and build a customer base

Penetration pricing uses low initial prices to win share fast. Virgin America used lower-than-average fares to enter the U.S. market and then adjusted prices as loyalty grew.

Price skimming: capture early adopters before lowering prices

Price skimming sets high prices at launch to capture early revenue from innovators. Apple is a classic example: new iPhones debut at premium prices, then older models drop in price.

Premium pricing: signal quality, justify higher margins

Premium pricing signals higher perceived value. Firms like McKinsey charge more when reputation and outcomes back the claim. That lets you protect margins while targeting selective customers.

Bundle pricing: increase perceived value and average order value

Bundle offers combine items into one price to boost appeal and move slow inventory. Think McDonald’s Happy Meal: combining products raises average order value and simplifies choice.

Loss-leading vs. predatory pricing: where to draw the line

Loss-leading draws traffic with a few low-priced items. Predatory pricing aims to eliminate competition and is illegal in many U.S. cases; tests like Areeda‑Turner guide courts.

“You’ll use penetration pricing to accelerate adoption and build a customer base, then normalize prices once loyalty is established.”

- Pick plays based on category dynamics and competition.

- Train teams on legal guardrails and how to fulfill demand at different price points.

- Test small, measure impact on sales, churn, and margins before scaling.

Pricing Models vs. Pricing Strategies: Don’t Mix Them Up

Models decide how you package offers; strategies decide how you set the dollar. You’ll pick a billing model to match customer habits and a separate approach to justify the final price. Mixing those up leads to confusing plans and weak margins.

Subscription, flat-rate, and tiered plans: packaging value for different customers

Subscription and flat-rate models make costs predictable for customers. Tiered plans give power users advanced features while keeping a simple option for mainstream buyers.

Use tiers to anchor the “best value” plan. That reduces choice overload and lifts conversions.

Freemium and pay-as-you-go: converting usage into revenue

Freemium (Dropbox) attracts users with free limits and nudges upgrades as needs grow. Pay-as-you-go suits products where usage varies and lets you capture value as customers expand.

How models and strategies work together to set the right pricing

Pick a model that fits customer behavior, then apply your chosen strategy — cost, competitor, or value — to set prices within that model. This way you package offers clearly and defend the price with facts about value and outcomes.

“Match the model to customer habits, and match the approach to the margin you need.”

Competing Smart: Market Monitoring and Price Adjustments

Smart companies monitor competitors so you make calm, data-backed price decisions. Set a steady cadence to watch the market, spot moves, and log events that might require action.

Cooperative, aggressive, and dismissive responses

Cooperative — match competitors to maintain share and avoid surprise churn.

Aggressive — cut below rivals to win volume fast, but test small to avoid margin damage.

Dismissive — hold or lead with your own prices when your value is clear and customers stay loyal.

When to hold, when to match, and when to lead on price

Define thresholds for action: cost guardrails, margin buffers, and competitive gaps. Use those rules so teams act consistently, not emotionally.

- Set monitoring cadence and signal triggers for immediate review.

- Choose response based on position, margins, and customer expectations.

- Assess risks like price wars and margin compression before reacting.

- Align communications so customers understand your decisions in market context.

“Decide your response rules ahead of time so you protect long-term health over short wins.”

Metrics, Guardrails, and Price Architecture

A well-built price architecture ties costs, demand, and customer tiers into clear rules. You’ll use measurable signals to keep your offers aligned with business goals and brand value.

Setting floors and ceilings with costs, inventory, and demand

Define a price floor from operating costs, COGS, and cost to serve. Add inventory levels and shipping costs so you never sell below what it takes to deliver.

Set ceilings from demand signals, perceived value, and competitor prices. That gives you a safe range to test without harming brand trust.

Track ARPU, margins, CAC payback, churn, and expansion

Measure what matters. Track ARPU and margin to see if prices fund growth. Monitor CAC payback time so acquisition is efficient.

Watch churn and expansion revenue to confirm your approach keeps and grows customers. Use these metrics to trigger reviews, not gut reactions.

Regional and time-based updates without hurting brand value

Calibrate regional prices and short-term changes to reflect costs and willingness to pay. Keep messaging clear so loyal customers don’t feel blindsided.

Create guardrails to prevent margin leaks from excess discounts. Build a coherent system of add-ons, bundles, and tiers so teams apply consistent rules.

- Floors: costs + cost to serve.

- Ceilings: demand, perceived value, competition.

- Metrics: ARPU, margin, CAC payback, churn, expansion.

- Controls: regional/time updates with clear customer communication.

“Use metrics to govern price moves so your company can act fast and protect long-term value.”

Execution Playbook: Apply Proven Frameworks to Your Pricing

Turn playbooks into repeatable moves so your teams act quickly and confidently.

GROW

Gauge market and customer needs, research model choices, and optimize for retention. Focus on offers that win revenue without sacrificing lifetime value.

SMART

Align your goals, pick a monetization mode, and build feedback loops. Use data to adjust and track the metrics that matter for retention and expansion.

PRO

Price by usage and real needs. Prioritize retention over short-term acquisition and protect profitability as you scale.

EDGE

Evaluate trends and competitors, design segmented plans, and evolve over time so you don’t lock into outdated approaches.

FIT

Focus on value-driving features and behavioral triggers. Craft scalable tiers that make upgrading an obvious next step for customers.

TEST

Run disciplined experiments, validate models, then scale winners. Watch churn and expansion carefully to confirm gains.

“You’ll use these playbooks to turn research into offers customers buy and keep.”

- Use GROW to stay retention-focused while scaling plans customers embrace.

- Use SMART to align your pricing with business goals and adjust with feedback.

- Use TEST to validate, scale, and monitor churn and expansion.

Conclusion

, End with an emphasis on practical steps you can run this quarter to protect profit and value.

You’ll leave with a clear roadmap to build, research, execute, and refine a pricing strategy framework that supports sustainable growth for your business.

Combine cost-based floors, competitor anchors, and value logic so your price fits the market and your customers accept it. Validate choices with conjoint tests and small experiments.

Pick the right model — subscription, tiered, or freemium — then iterate using metrics and guardrails. This way teams in your companies act fast and protect margins while growing sales.

Make it a repeatable way to set price: test, measure, and communicate changes clearly so customers stay and profit follows.