Last Updated on January 4, 2026

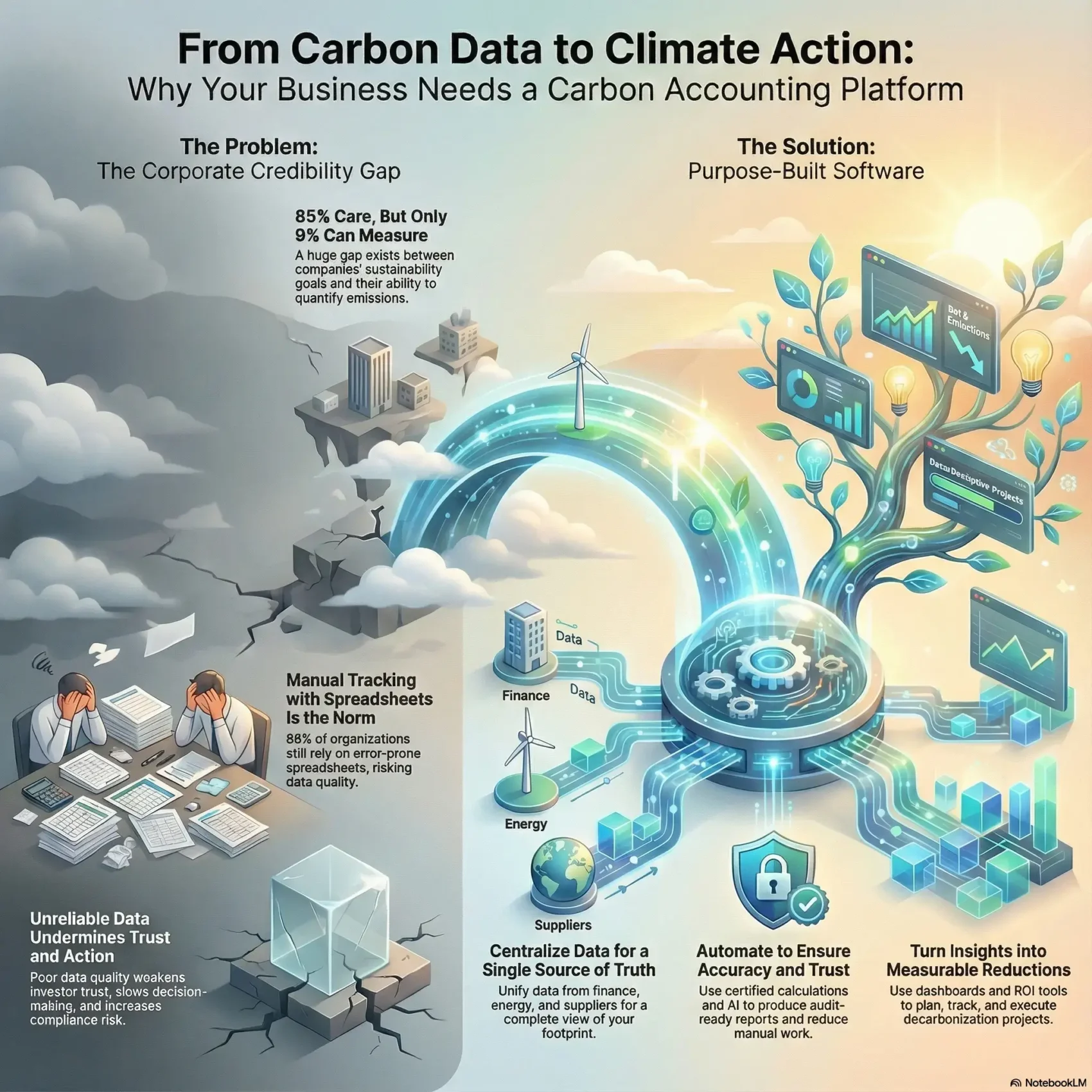

You need clear, trusted data to move from good intentions to real climate action. A recent BCG study found 85% of organizations care about reducing greenhouse gas emissions, yet only 9% can fully quantify them. That gap makes it hard for your company to plan credible reductions or meet growing reporting demands.

Modern platforms bring emissions data, reporting, target setting, and action planning into one place. They let you collect scalable inputs, run certified calculations, and produce audit‑ready outputs. Many also use AI to map data and flag anomalies so your team spends less time fixing spreadsheets and more time reducing impact.

Throughout this guide, you’ll learn what these tools do, which features matter, and how to compare vendors for enterprise, Scope 3, and SMB needs. By the end, you’ll have a practical checklist to choose a platform that turns your footprint data into measurable reduction steps.

Key Takeaways

- Most organizations care about emissions but few can quantify them without purpose-built systems.

- A unified platform centralizes data, reporting, targets, and action planning.

- Certified calculations and audit-ready outputs improve trust and compliance.

- AI features speed data mapping and detect anomalies to cut manual work.

- This guide will compare vendors and give a checklist to pick the right solution for your needs.

Why now: You need reliable carbon data to act with confidence

Accurate emissions numbers turn sustainability intent into measurable business outcomes. You face a credibility gap: most leaders say climate matters, but few can fully quantify their footprint. That mismatch weakens investor trust and slows strategic action.

The gap: 85% care about reducing emissions, but only 9% can quantify them

BCG found 85% of organizations want to cut greenhouse gases, yet only 9% can measure total emissions. An SAP survey adds that 86% still use spreadsheets and many mid-market executives doubt their data quality.

From manual chaos to clarity: Aligning your emissions data with real business decisions

Spreadsheets and scattered sources introduce errors, versioning problems, and gaps. That makes reporting weak and analysis unreliable.

- Centralized data enables hotspot discovery and ROI‑first project prioritization.

- Standardized methods let you compare units, suppliers, and time periods.

- Clean inputs reduce reputational and compliance risk as rules expand.

Automation frees your team to focus on reductions, not reconciling files, and supports SBTi alignment and board‑level oversight.

What carbon accounting means for your business today

Making your company’s footprint visible lets finance, ops, and procurement act on high‑impact opportunities. A single, standard measure of greenhouse gases helps teams speak the same language and prioritize what saves money and emissions.

Carbon as a catch‑all: CO2e and other GHGs under the GHGP umbrella

CO2e stands for carbon dioxide equivalent and bundles gas types like methane, nitrous oxide, and HFCs into one comparable unit. This standardization makes target setting and benchmarking possible across sites and suppliers.

“Using CO2e lets you compare different sources on the same scale and set meaningful reduction goals.”

Scopes 1, 2, and 3 explained in plain English

Scope 1 is what you directly emit from fuels and fleet. It is usually the easiest to measure.

Scope 2 covers purchased electricity, heat, or steam. Switching energy sources or contracts can deliver fast wins here.

Scope 3 captures emissions across your value chain — suppliers, logistics, and product use. For many companies, this is the largest share and the hardest to map.

- Start with Scopes 1 and 2 for quick visibility and cost savings.

- Phase into Scope 3 by engaging suppliers and improving data quality.

- Use audit‑ready reporting aligned to the GHGP to support SBTi targets and investor disclosures.

Good tools streamline category mapping, emission factor selection, and data‑quality scoring so your analysis becomes reliable and actionable. That clarity turns insights into procurement choices, energy contracts, logistics changes, and product design improvements.

Carbon accounting software: Essential features that actually move the needle

A practical system blends wide-ranging collection methods with certified calculations and project tracking to drive real change. You should expect a platform that reduces manual work and turns data into prioritized actions.

Data collection at scale

Manual inputs, bulk imports, and APIs let you gather data from finance, energy meters, ERP, and procurement without constant rekeying. That breadth improves hygiene and speeds audits.

AI anomaly detection flags odd entries, learns your naming conventions, and speeds mapping so submissions scale across regions and teams.

Certified calculations and trust

Certified engines produce an audit-ready Corporate Carbon Footprint across Scopes 1–3. TÜV-certified math and SOC 2/GDPR controls boost investor and auditor confidence.

Reporting that matches stakeholders

Flexible exports — PDFs for narratives, CSVs for deep analysis, and APIs for system-to-system feeds — meet regulators, customers, and internal reviewers.

Decarbonization planning and dashboards

Use scenario tools to set SBTi-aligned targets and compare project ROI. Dashboards translate inventories into clear insights with filters for sites, suppliers, and categories.

Action planning and Scope 3 integration

Action modules assign owners, timelines, and budgets, then track completion and quantified reductions. Supplier portals and surveys lift primary data quality over time.

“A capable platform becomes your single source of truth to operationalize sustainability goals and hit milestones.”

- Governance: audit trails, data lineage, and permissions reduce risk.

- Capabilities: AI mapping, certified math, and ROI modeling speed decision-making.

- Outcome: better tracking, clearer insights, and measurable reduction.

How to choose the best carbon accounting software for your company

Pick a system that turns data into decisions, not a repository that gathers dust. Your goal is durable emission reductions, not reports that sit in a drawer. Start with clarity on scope coverage and the outcomes you expect in year one.

Prioritize decarbonization over offsets for durable impact

Focus on reduction first. Favor platforms that help you evaluate projects and measure avoided emissions. Offsets can complement strategy, but the platform should drive real operational change.

Check GHG Protocol alignment and third‑party certifications

Confirm GHGP alignment and certifications like TÜV Rheinland or equivalent. Audit-ready reporting, unified auditing, and clear data lineage let you trace every figure back to source with version control and permissions.

Demand integrations and usability

Verify APIs to ERPs, utilities, procurement, and finance to cut manual work. Test the UI with non-expert users; embedded guidance and templates speed adoption across teams.

Support, proof, and scalability

- Ask about sector specialists, onboarding, and ongoing success management.

- Check references, analyst recognition, and partnerships (CDP, PCAF) for market credibility.

- Evaluate scenario analysis and ROI tools to prioritize initiatives and build your business case.

Final choice tip: Pick a platform that scales with your company, covers all scopes including supplier engagement, and pairs data-grade reporting with hands-on support.

The best carbon accounting software in 2026: Our roundup

To save time, we’ve grouped top vendors by strengths so you can shortlist quickly based on your priorities and tech stack.

Enterprise leaders — Persefoni, IBM Environmental Intelligence Suite, and Sphera shine for scale, audit‑grade reporting, and risk analytics. Persefoni stands out for GHGP/PCAF alignment, a Footprint Ledger, and AI anomaly detection. IBM adds climate risk modeling to emissions management. Sphera pairs centralized reporting with LCA capabilities for complex ESG work.

Ecosystem fits

If you run Microsoft or Salesforce across the business, their native tools cut integration effort and speed time to value.

Decarbonization‑first platforms

Plan A and SINAI emphasize TÜV‑certified workflows, scenario modeling, budgeting, and ROI‑based project selection to prioritize reductions over offsets.

Supply chain and Scope 3 focus

Emitwise (now part of Watershed) and Sweep target supplier engagement and value‑chain data. They help lift primary inputs, though Sweep may have scaling limits for very large programs.

SMB‑friendly options

Greenly and Diligent ESG offer approachable UX and compliance support without enterprise overhead. They’re good if you want fast setup and clear reporting at modest pricing.

“Map vendors to your use case, stack, and long‑term needs to avoid costly rework later.”

- Match: enterprise for audit needs; ecosystem tools if you’re already on Microsoft or Salesforce.

- Prioritize: decarbonization workflows if you need ROI‑first projects, or supply‑chain tools for Scope 3.

- Watch: scalability, customization, certifications, and pricing tiers when you shortlist.

When to pick which platform: Match software to your use case

Choosing the right platform starts with your stack, your biggest emissions sources, and how fast you need results. Don’t pick by logo alone. Look for a match between your technical systems, reporting needs, and the team that will run the program.

If you’re already on Microsoft or Salesforce, leverage native integrations

Native tools cut integration cost and speed rollout. Microsoft Sustainability Manager works with Azure, Power BI, and Dynamics for smooth data flows. Salesforce Net Zero Cloud fits into Salesforce apps and partner networks like Accenture.

That reduces manual mapping and helps you scale tracking across sales, ops, and finance.

If you need audit‑ready finance‑grade reporting, go enterprise‑class

Enterprise platforms deliver governance, version control, and certified math. Consider Persefoni, IBM Environmental Intelligence Suite, or Sphera for finance‑grade reporting and complex management needs.

These systems support rigorous workflows, permissions, and investor‑ready outputs when your company must meet strict disclosure rules.

If Scope 3 and supplier engagement are your hotspots, favor supply‑chain tooling

Scope 3 demands supplier portals and surveys. Tools like Emitwise (Watershed) and Sweep focus on value‑chain data. If you need project ROI and scenario modeling, evaluate Plan A or SINAI for decarbonization planning.

Consider the data sources you must connect—utilities, ERP, procurement—and pick platforms with proven APIs, connectors, and strong onboarding support.

“Align your selection with the next 12–36 months of your sustainability plan to avoid costly replatforming.”

For a practical shortlist, map priorities (integration, reporting, supplier reach) to vendor strengths. If you want guidance on vendor strategy, read our take on ESG SaaS strategies to shape your final choice.

Software vs. spreadsheets: Time, accuracy, and compliance are on the line

Spreadsheets can feel familiar, but they often hide errors that slow decision-making and raise regulatory risk. Today, 86% of organizations still rely on manual files for emissions tracking, and only about one in three mid-market leaders say their data quality meets expectations (SAP). That gap costs you time and raises compliance exposure as rules tighten.

Most companies still track in spreadsheets—at real risk to quality and scale

Spreadsheets break at scale. Opaque formulas, scattered versions, and manual copy/paste introduce mistakes that undermine your reporting and stakeholder trust.

When you rely on hand-built files, reconciling across regions or suppliers becomes slow and error-prone. Auditors and regulators expect traceable, verifiable records — and manual work makes that hard to show.

Automation and standardization beat manual processes every time

Automation reduces manual tasks and standardizes calculations so your team spends less time reconciling and more on reduction planning.

- Centralized systems ingest and validate data for consistency across entities.

- Audit-ready architectures give you data lineage, permissions, and tamper-resistant records.

- Dashboards and alerts flag anomalies, missing inputs, or outliers before filing deadlines.

- APIs keep reporting synced with operational systems as your business changes.

“Better data in less time, with stronger governance and auditability.”

The bottom line: moving from manual files to purpose-built tools cuts risk, improves accuracy, and future-proofs your compliance and reporting so you can focus on measurable reductions.

Pricing, total cost of ownership, and ROI

Price alone won’t tell you what a system will really cost. Licensing is just the headline. Your true spend comes from integrations, onboarding, and ongoing support that keep your reporting accurate and your reduction projects on track.

What to expect: From starter tiers to six‑figure enterprise plans

Expect a wide spectrum: SMB subscriptions can start low, while enterprise deployments reach six figures annually. Examples range from Microsoft Sustainability Manager (~$4,000/month) to Salesforce Net Zero Cloud (~$210,000/year), IBM EIS (~$134,000/year), Emitwise (~$127,000/year), and Persefoni’s advanced tiers (~$55k–$250k/year).

Persefoni also offers a free Pro tier, which helps smaller companies test features before scaling.

Building your business case: Time savings, risk reduction, and cost avoidance

Your TCO should include licenses, implementation (APIs/ETL), change management, and any assurance or audit support required for compliance.

- Time savings: Automation cuts manual entry and peak reporting effort, often offsetting licenses.

- Risk reduction: Stronger controls and audit readiness lower rework and restatement risks.

- Value from insights: Scenario analysis and ROI tools help you prioritize reduction projects that reduce energy spend and future liabilities.

“Model a 3‑year ROI with conservative assumptions for labor savings, improved data quality, and avoided penalties.”

Also factor modular add‑ons (Scope 3 supplier portals, regulatory modules) and realistic internal resource commitments to avoid hidden costs. Choose a solution that meets your goals today and scales without runaway expenses.

Compliance, audit readiness, and sustainability reporting

You need systems that make compliance predictable as rules evolve. Pick a platform built on GHGP methods and that supports SBTi targets so your disclosures stay credible. Modern systems map inputs to required categories for CSRD, SEC rules, and California SB‑253.

Unified auditing, data lineage, and tamper‑resistant records

Trace every number back to source, owner, and version. Unified auditing and clear data lineage make external assurance faster and cheaper. Tamper‑resistant ledgers and role‑based permissions lower manipulation risk and support internal controls.

Built for evolving regulations and exports

Choose configurable reporting templates that map to CSRD, SEC, and state rules. Export flexibility (PDF, CSV, API) keeps your team ready for regulator portals, investors, and internal analysis.

Partner ecosystems that future‑proof your reporting

Vendors with assurance partners, system integrators, and data providers help you adapt quickly. Look for participation in standard‑setting bodies as a signal of durability and reduced regulatory risk.

“Audit-ready processes make sustainability reporting verifiable and repeatable.”

- GHGP and SBTi alignment for credible targets

- Data lineage and tamper‑resistant records for faster assurance

- Partner networks to keep you compliant as regulations change

Real‑world results: How companies turn carbon data into action

Real results often start when teams stop collecting data and start using it to guide decisions. For many companies, turning numbers into projects makes reporting meaningful. AMPECO’s work with Plan A shows how a focused approach produces measurable wins.

AMPECO: Cutting data entry time by up to 80% and unlocking insights

AMPECO streamlined collection using Plan A’s platform and cut routine data entry by as much as 80%. Custom dashboards made hotspots visible fast, so teams could prioritize high‑impact emissions categories.

From report to reduction: Translating analytics into a credible action plan

Plan A combined TÜV‑certified calculations, SOC 2 and GDPR compliance, and AI‑assisted mapping to lift data quality quickly. Expert support then helped the business map analytics into a sequenced plan with owners and timelines.

- Project tracking tied initiatives to measured reduction and improved governance.

- Audit‑ready records and certified math boosted internal and external confidence.

- Clear ROI visuals secured budget and leadership buy‑in for next steps.

“When your platform unifies data, reporting, and planning, momentum follows.”

The takeaway: start with a robust baseline, focus on the biggest levers, and iterate. Companies that pair automation with expert support see faster tracking, clearer insights, and lasting sustainability management gains.

Carbon accounting software

Use a clear checklist to pick a platform that actually helps you turn data into action. The right tool should cut manual work, support assurance, and scale as your company grows.

Your checklist: Features, integrations, support, and scalability

Confirm data collection options—manual entry, bulk imports, and APIs—to cover utilities, travel, procurement, and facilities. Make sure the vendor has a public roadmap for new collection sources you need.

Require GHGP alignment and third‑party certification plus transparent data lineage so audits are simple and verifiable.

Validate multi‑framework reporting that can output CSRD, SEC, and common customer questionnaires without manual reshaping.

- SBTi support and scenario tools: check for goal setting, ROI calculators, and prioritization workflows.

- Dashboards that drive decisions: filters, drilldowns, alerts, and actionable views—not just charts.

- Scope 3 supplier tools: supplier portals, category coverage, and a plan to lift primary data over time.

- Security and compliance: SOC 2, GDPR, and role‑based access controls to satisfy IT and audit teams.

- Integrations with your systems: ERP, EPM, BI, and an open API to avoid vendor lock‑in.

- Expert support and references: proven deployments in your sector and region with active partnerships.

- Scalability: the platform must handle more data, more entities, and more reporting obligations as you grow.

“Pick a platform that scales with your data and gives you audit-ready outputs so you can move from tracking to reduction.”

Final tip: run a short proof of value focused on one high‑impact category. That demo will reveal if the features, integrations, and support you need are truly in place.

Conclusion

, You now have a clear path: start with verified data, then use scenario tools and ROI analysis to turn insights into prioritized projects that cut emissions and costs.

Match your platform to your stack and maturity—enterprise, ecosystem-native, or SMB-friendly options all exist. Prioritize GHGP alignment and unified auditing to future-proof compliance and assurance.

Engage suppliers to lift Scope 3 quality, factor TCO and ROI into your business case, and lean on partners for changing rules. For a vendor perspective and integration examples, see our QuickBooks Online review.

Start with a strong, practical plan, iterate from a solid baseline, and you’ll deliver investor-grade reporting and measurable footprint reduction at pace.