Last Updated on December 13, 2025

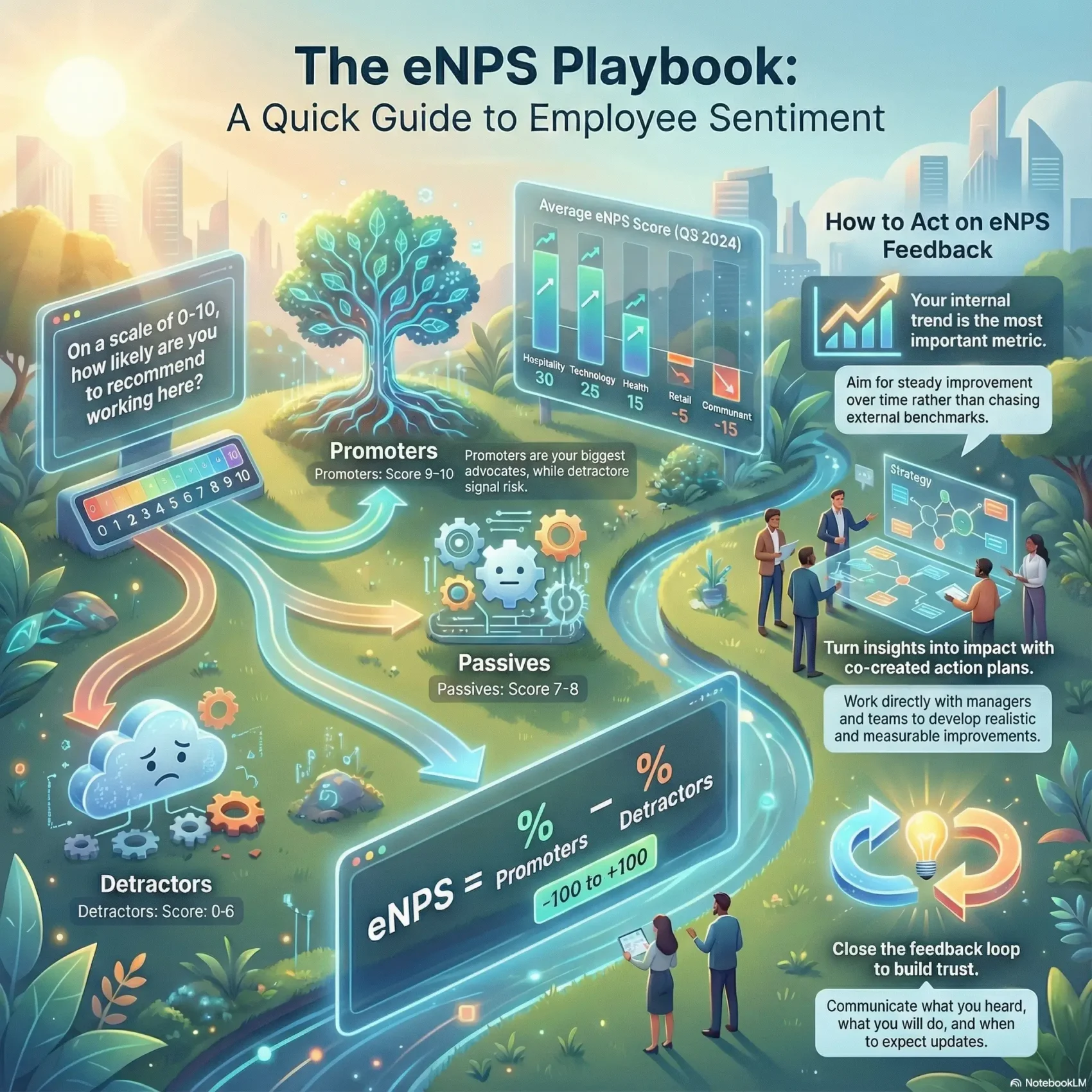

Employee Net Promoter Score (eNPS) gives you a fast, clear view of how your people feel about your company. It hinges on a single 0–10 question and a brief follow-up for comment. The math is simple: %Promoters minus %Detractors, so scores run from -100 to +100.

That simplicity makes it a practical survey tool for regular pulse checks. Benchmarks often sit in the low teens across broad datasets, though industries vary. Tracking trends over time matters more than a single number.

Use eNPS to move beyond guesswork. It links sentiment to engagement, satisfaction, and real business outcomes. When leaders act on feedback, the whole workplace can become more productive and profitable.

Key Takeaways

- eNPS is a one-question tool scored from -100 to +100.

- It pairs a numeric rating with short qualitative feedback.

- Benchmarks help, but your trend line tells the real story.

- Regular tracking ties sentiment to engagement and outcomes.

- Share results clearly to build trust and spur action.

What you’ll learn in this Ultimate Guide to employee NPS

This guide lays out clear steps and practical advice so you can measure and act on workforce sentiment. You’ll get definitions, the math behind the score, and simple examples that make calculation and sharing results easy.

Expect focused coverage on benchmarks by industry and size, plus why improving internally matters more than chasing outside averages. You’ll also find guidance on writing concise questions and follow-ups that yield useful feedback.

We explain survey design best practices, cadence options (quarterly, biannual, or milestone-triggered), and segmentation techniques by team, tenure, location, and role. Those tactics help surface targeted insights you can act on.

- How the employee net promoter concept and net promoter score work

- Exact formula and quick math examples to report results confidently

- Action planning, improvement strategies, and tools to scale

- Tips to boost response rates and protect anonymity

- Limitations and how to pair this metric with richer feedback

Understanding the employee net promoter concept

A compact survey question can act as an early warning light for culture and engagement.

What it measures: An enps survey asks one clear question: “On a scale of 0-10, how likely are you to recommend working at this company to a friend or colleague?”

Responses sort into three groups: Promoters (9–10), Passives (7–8), and Detractors (0–6).

Why it matters right now

This metric captures whether people would likely recommend your workplace. That advocacy reflects loyalty and satisfaction.

In fast-changing times, enps provides near real-time sentiment so your organization can act before issues hit retention or performance.

How it differs from customer net promoter

Both use the same 0–10 scale and the same math: %Promoters minus %Detractors. But the focus shifts from buyers to staff.

When your people are promoters, customer experience often improves too. Use both signals to see how culture and service move together.

- Single question, fast response, clear categories

- Quick trend tracking for leaders and managers

- Actionable signal tied to loyalty and daily satisfaction

How eNPS works: the core question, scale, and categories

Start with one straightforward question and a consistent scale to capture sentiment quickly. Below you’ll get the exact wording and practical rules for scoring and handling results.

The standard question and the 0–10 scale

Core question: “On a scale of 0-10, how likely are you to recommend working at this company to a friend or colleague?”

Present the same 0–10 scale every time to keep results comparable. A clear display and a 1–2 minute completion time help response rates for your enps survey.

Promoters, Passives, and Detractors explained

Responses break into three groups: Promoters (9–10), Passives (7–8), and Detractors (0–6). Promoters signal strong advocacy; detractors flag problems to address.

The net promoter score uses %Promoters minus %Detractors. Passives are excluded from the formula but matter for trend analysis.

- Keep wording exact to avoid bias in the question and scale.

- Pair a short open prompt for feedback so the organization gets context.

- Use reporting guardrails (minimum group size) to protect anonymity.

- Quick checklist: same question, same scale, short follow-up, and consistent cadence for reliable measuring enps.

Calculating your eNPS score step by step

Start by converting response counts into percentages, then subtract detractors from promoters to see the net result. The formula is simple:

Formula and quick math examples

eNPS = %Promoters − %Detractors. If 60% of respondents are promoters and 15% are detractors, the enps score is 45.

Work with raw counts or percentages. Example: a company of 60 with 30 promoters, 20 passives, 10 detractors gives:

- (30 − 10) / 60 × 100 = 33.3 → enps score 33.3

- A 1,000-person survey with 400 promoters and 450 detractors → (400 − 450) / 1000 × 100 = −5

Interpreting positive, neutral, and negative results

Positive scores show advocacy and often correlate with higher retention and morale.

Neutral or small scores mean you should dig into comments and segment results by team or location.

Negative scores signal risk and call for targeted action plans. Watch for small-group volatility and set minimum response thresholds before public roll-ups.

“Pair the numeric score with selected quotes to connect results to real experiences.”

What is a good eNPS? Ranges, thresholds, and context

Understanding what different ranges mean gives you context to prioritize actions and set realistic goals. The scale runs from -100 to +100, and each band signals distinct levels of advocacy and risk.

Score ranges from -100 to +100 and what they signal

Anything above zero means more promoters than detractors. Many practitioners call 10–30 good, 50–70 excellent, and >80 exceptional.

Keep in mind context: industry, labor market, and company size shape what’s realistic. Use confidence intervals and response rates to judge whether a change is meaningful.

Why “better than last time” beats chasing external averages

Trend beats target. Improvement over time shows real momentum. A small upward move can matter more than a high but flat benchmark.

- Focus on sustained improvement and root causes.

- Expect swings during reorganizations or busy seasons.

- Align leaders so a single-point dip doesn’t cause panic.

“Use scores as a signal, then dig into comments to drive lasting improvement.”

Current eNPS benchmarks by industry and company size

Benchmarks give context, not answers. Use them to frame conversations about your culture and retention, then rely on your own trends to guide action.

Present-day benchmarks across sectors in the United States

Recent snapshots put the overall net promoter score near the mid-to-high teens, with a Q3 2024 figure around 27.

Sector-level examples show wide variation: Health 15, Manufacturing 15, Hospitality 30, Nonprofit 10, Technology 28, Retail -5, Education 0, Government -15.

How organization size influences eNPS

Smaller companies (0–250) often average about 30. Proximity, agility, and tight culture help boost promoter score in these workplaces.

Very large companies (5,001+) tend to sit near single digits (about 9). Scale, bureaucracy, and varied experiences across locations lower aggregate scores.

When and how to use benchmarks responsibly

Benchmarks are best for setting directional goals, not rigid targets. Compare by sector, size, and role to find relevant peers.

Tip: Track score changes alongside internal events—reorgs, pay cycles, or policy shifts—to explain movement that benchmarks can’t.

- Use segmented comparisons (team, tenure, location) for clarity.

- Revisit benchmarks annually to avoid overreacting to noise.

- Blend external context with your own results when briefing leaders.

Designing an effective eNPS survey with open-ended questions

Short, well-chosen follow-ups reveal why people gave the score they did. Start with the core rating and add one or two targeted prompts. Keep the form tight so each enps survey takes 1–3 minutes to finish.

Follow-up prompts that surface actionable insights

Use concise prompts such as: “What’s the primary reason for your score?” and “What can we improve?” These open-ended questions let respondents add context without writing an essay.

Group qualitative feedback into themes—communication, workload, growth—to find patterns quickly. Summarize common threads and pair them with representative quotes when you report results.

Balancing brevity with depth to avoid survey fatigue

Offer optional comment boxes rather than mandatory fields. That preserves depth for those with strong views while keeping response friction low for others.

- Standardize wording to keep data comparable across cycles.

- Tailor prompts for new hires, managers, or frontline teams for sharper insight.

- State anonymity and how feedback will be used to build trust.

“Capture the score, then ask one clear why-question — action follows clarity.”

When you design this way, the employee net promoter process becomes both fast and useful. You get reliable signals and clear paths for improvement in your organization and culture, while protecting respondent time and satisfaction.

Employee NPS in practice: cadence, timing, and real-time tracking

Cadence shapes the clarity of your feedback: too frequent and you risk fatigue, too rare and you miss trends. Many HR teams run enps surveys quarterly or biannually. Growing organizations often pulse more often during change.

Quarterly vs biannual vs milestone-triggered pulses

Quarterly checks give fresher signals for managers and boost engagement with steady rhythm. Biannual surveys reduce burden and suit stable periods.

Milestone-triggered surveys work well after reorganizations, policy updates, or leadership changes. Use an enps survey when a specific event could shift sentiment.

Capturing timely sentiment during change

Stagger sends across teams to lower simultaneous load. Create lightweight feedback loops so managers get quick results and can act.

- Align survey windows with planning cycles.

- Use real-time dashboards to watch results as responses arrive at scale.

- Set SLAs for analysis and communicating next steps across your organization.

“Time your surveys to avoid peak workload and let insights inform upcoming decisions.”

Segmenting and analyzing your results for clarity

Divide the feedback into meaningful groups to reveal patterns that raw scores can hide.

Slicing by team, tenure, location, and role

Start by breaking results down by team, tenure, location, and role so you can spot bright spots and pain points quickly.

Map comment themes back to each segment to see whether issues are local or span the whole organization.

Protect anonymity by enforcing minimum group sizes before you publish segment-level results.

Spotting trends and themes in qualitative feedback

Group comments into a simple taxonomy—communication, leadership, workload, and growth—to accelerate analysis.

Track cohort trends over time to test whether your interventions deliver real improvement.

Correlate scores with outcomes like attrition and absenteeism to prioritize high-impact areas.

- Compare segments to find where managers or teams are driving change.

- Use filters safely to preserve anonymity and trust.

- Prepare clear visualizations so leaders and teams can act fast.

“Segment, code, and visualize feedback—then target the few changes that move scores and culture.”

From insight to impact: turning eNPS feedback into action

Numbers tell a story, but your next step is to translate that story into a focused plan with clear owners and deadlines.

Co-creating action plans with managers and teams

After you analyze trends and segment results, invite managers and their teams to workshop solutions. Co-create a short list of improvements that are realistic and measurable.

Define owners, timelines, and success measures so each task has accountability. Small, sprint-style actions often win faster trust than large, vague programs.

Closing the loop to build trust and participation

Communicate what you heard, what you will do, and when employees can expect updates. Share both quick wins and a roadmap for longer initiatives.

- Use manager toolkits with discussion guides and templates.

- Celebrate short-term wins while tracking longer goals.

- Set recurring checkpoints to review progress and adjust plans.

“Close the loop: when people see feedback turn into action, participation and engagement grow.”

Proven strategies to improve employee engagement and eNPS

A clear plan that links feedback to action is the fastest route to stronger workplace culture. Start with a few focused moves that show real progress quickly. That builds trust and invites wider participation.

Culture and leadership: communication, trust, and transparency

Improve leadership communication with weekly updates and clear priorities. Make transparency a habit—share both progress and setbacks.

Result: stronger culture and better two-way trust across the company.

Career growth, learning, and development

Create clear career paths, mentorships, and short learning sprints. Offer practical skill courses tied to performance reviews.

This boosts job satisfaction and long-term loyalty.

Recognition, rewards, and work-life balance

Design recognition programs that highlight small wins and public shout-outs. Introduce flexible schedules and workload checks to cut burnout.

These moves lift employee satisfaction and create visible promoter behavior from quiet supporters.

Compensation and benefits as retention levers

Review pay and benefits annually to stay competitive and fair. Pair financial reviews with perks that support wellbeing and work-life needs.

“Use feedback to refine what matters most and link each initiative to measurable retention and engagement goals.”

- Strengthen workplace culture via better leader communication.

- Design growth paths and learning tied to job satisfaction.

- Implement regular recognition and flexible work to reduce burnout.

- Review compensation to support employee retention.

- Build simple rituals—1:1s, town halls, and shout-outs—to keep momentum.

Boosting eNPS response rates without burnout

You’ll boost participation when invites match how your teams prefer to communicate. Start by personalizing subject lines and preview text so messages feel human and relevant.

Pick the channels your employees actually use—email, SMS, workplace apps, or QR codes on kiosks. Keep the enps survey short: the core rating plus one or two follow-ups.

Automate sends after milestones like onboarding, promotions, or launches so timing captures honest, timely feedback without extra work.

Ensuring anonymity and clearly stating purpose

Be explicit about anonymity and how results will be handled. That builds trust and reduces social fear when people answer sensitive questions.

Explain why you’re asking and how insights will lead to real improvement. Promise follow-up and then show results and actions so future participation rises.

- Personalize invites and reminders to raise opens and completions.

- Pick channels that fit daily habits to make participation effortless.

- Keep it brief to avoid survey fatigue and boost honest answers.

- Automate timing around events to capture relevant sentiment.

- Share how results map to change to motivate responses.

“When people see feedback turn into action, participation and trust grow.”

Limitations of eNPS and how to complement it

Numbers give you a quick signal, but they rarely explain why scores move. A single score can mask very different reasons for similar ratings. For example, two low responses may stem from opposite issues: workload versus leadership clarity.

Why a single number needs qualitative context

Use the score as a starting point, not the full story. Short metrics show direction, while comments reveal root causes and practical areas for improvement.

Pairing eNPS with pulse surveys and interviews

Combine regular enps surveys with quick pulse surveys to track near-term shifts. Add interviews or focus groups to probe surprising trends.

- Open-ended questions give the “why” behind a rating and guide actions.

- Pulse surveys catch changes between formal cycles and keep leaders informed.

- Interviews and focus groups uncover specific drivers tied to retention and culture.

Balance matters: avoid chasing a numeric target at the cost of real change. Use mixed methods to link feedback to concrete steps across teams and the wider company.

“Treat the score as an alert. Use qualitative data to design solutions that improve satisfaction, engagement, and retention.”

Tools and dashboards to run and scale eNPS programs

Choose platforms that turn scattered feedback into clear, actionable dashboards. Good tools give you templates, automated schedules, and secure segmentation so setup is fast and repeatable.

Survey platforms should support consistent question wording, role-based access, and privacy thresholds. That protects anonymity while letting managers see meaningful trends.

Survey platforms, analytics, and reporting best practices

Build dashboards that show real-time response rates, score trends, and hot spots by team. Integrate open comments so qualitative context travels with each numeric result.

- Pick tools that automate cadence and scale securely for your company.

- Standardize wording and timing to keep comparisons reliable across cycles.

- Set reporting cadences so executives and managers get timely results and action items.

Operationalizing enps with real-time insights

Use alerts and tags to route urgent feedback to owners quickly. Link dashboard views to improvement plans and track progress visibly so teams see change.

When results arrive fast, you can act faster—and turn feedback into measurable improvement.

For background on how feedback fits wider people practices, see the future of performance reviews.

Conclusion

A concise score, paired with comments, becomes a practical roadmap for change. Use the employee net promoter rating as a fast pulse, then add context to turn signals into solutions.

Keep reports segmented and timely so managers can act. Combine the net promoter number with short follow-ups to surface themes, track trends, and share clear results that boost engagement and satisfaction.

Make small experiments, measure impact, and repeat. When you close the loop, employees see progress and trust grows. Over time, your company and organization will gain stronger loyalty, real improvement in work, and a healthier workplace.